In a move that stunned China currency watchers, late on Friday (local time) Bloomberg reported that China’s central bank decided that it would remove a reserve requirement for financial institutions trading in FX forwards for clients by cutting it to zero from

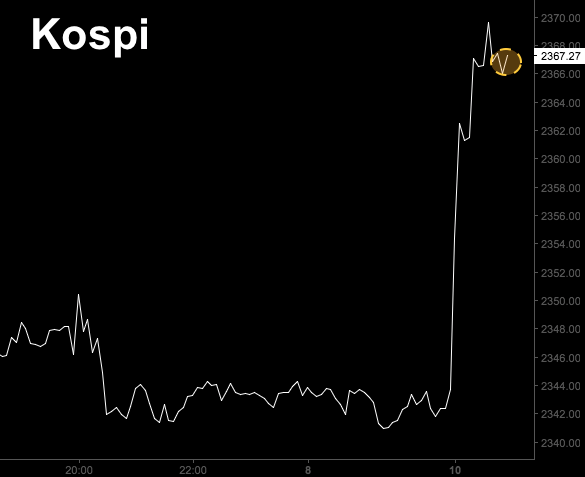

September 10, 2017