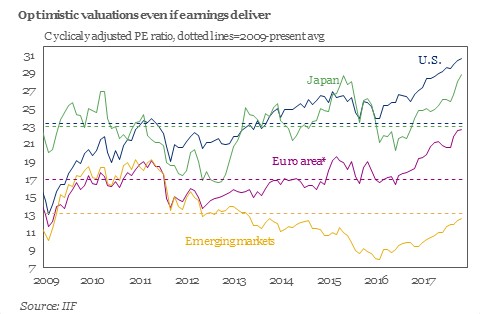

As we keep insisting, monetary central planning systematically falsifies asset prices and corrupts the flow of financial information. That’s why bubbles seemingly inflate endlessly and egregiously, and also why financial crashes and economic corrections appear to come out of the blue

November 15, 2017