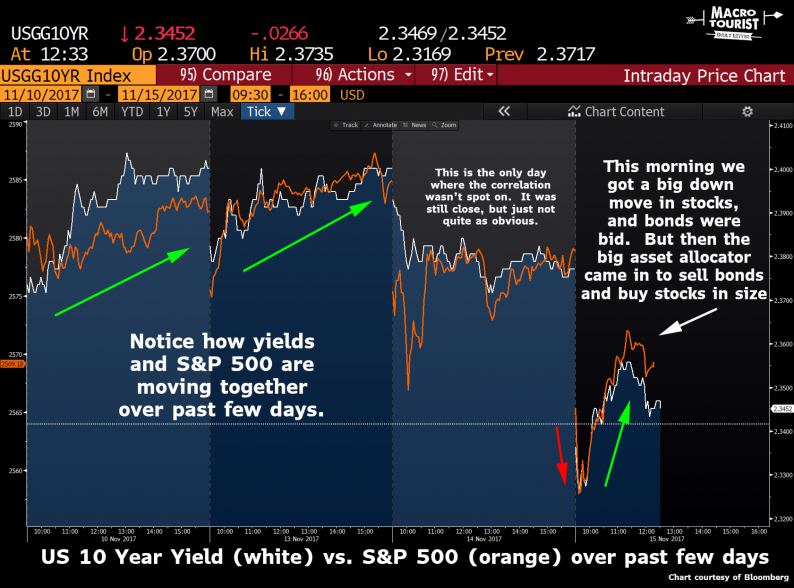

The other day, CALPERS created a little bit of a stir with news they were considering increasing their bond allocation while selling down the stock portion of their portfolio. From Reuters: The California Public Employees’ Retirement System, the largest U.S.

November 15, 2017