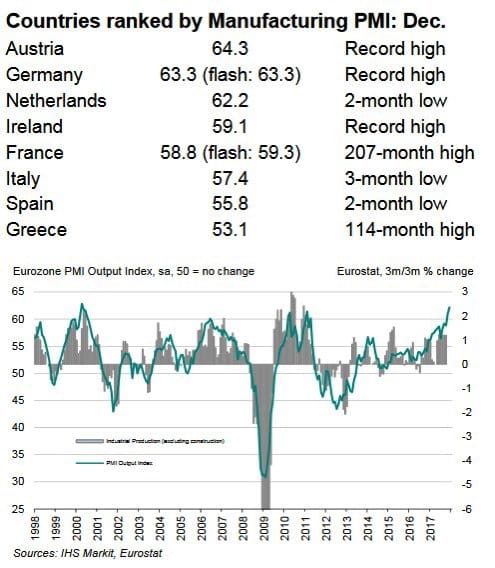

The European PMIs that came out today showed an EU economy that is not just in full recovery mode, but booming. Likely the ECB will reduce its level of accommodation in line with this growth. Focusing just on the Eurozone,

January 2, 2018

2017 was the year of growth over value—year-to-date through December 1st, the S&P 500 Growth Index outperformed the S&P 500 Value Index by essentially double the return, or a 1,300 basis point (bps) spread. Year-to-Date Total Returns of Value vs. Growth This performance advantage for growth investing largely stemmed