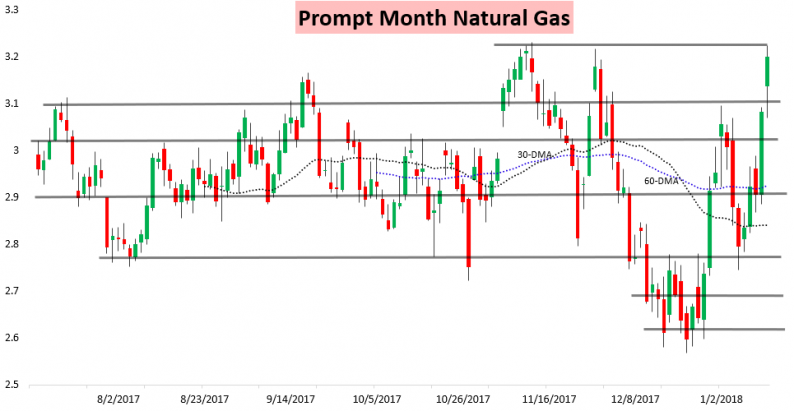

We had another wild day of natural gas trading today, with prices experiencing significant volatility this morning in attempting to pull back before slightly colder afternoon weather model guidance sent prices rallying into the settle. Like yesterday, where you look

January 12, 2018