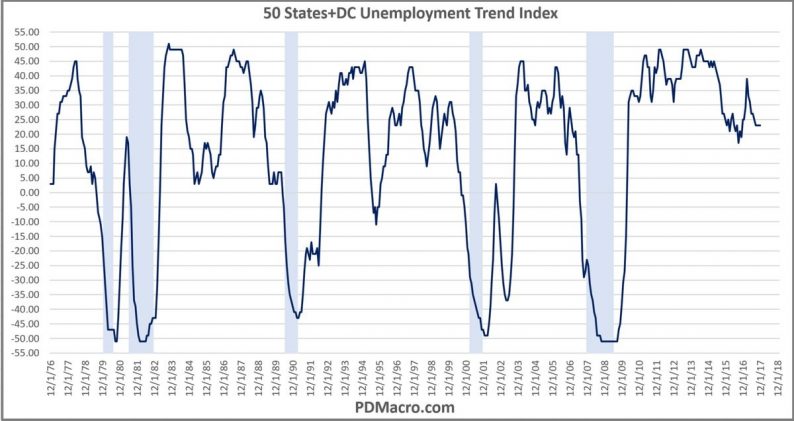

Declining Labor Momentum The chart below shows the net number of states with increasing or decreasing unemployment rates. This is like a breadth indicator for the labor market. As you can see, there are about 23 more states with decreasing

February 20, 2018