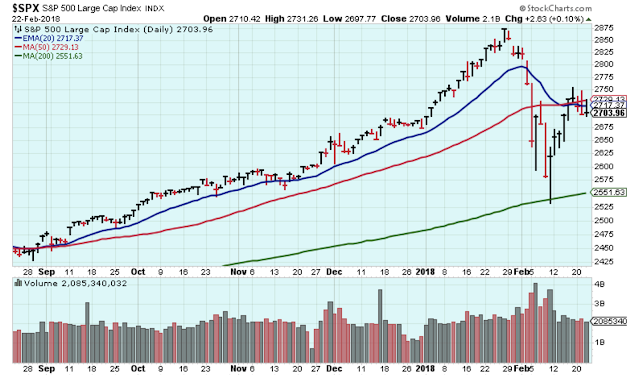

The deficits facing the United States have put the nation in the unenviable position of an expensive place to go looking for capital. As the Federal Reserve takes dead aim at higher short-term rates in its quest for normalization, the

February 22, 2018