For GDPNow, a strong factory report could not overtake weak housing and trade reports. Divergence with Nowcast widens. The divergence between GDPNow and the New York Fed Nowcast GDP estimates widened to 0.9 percentage points in the past week. GDPNow Latest Forecast: 1.8 Percent

March 16, 2018

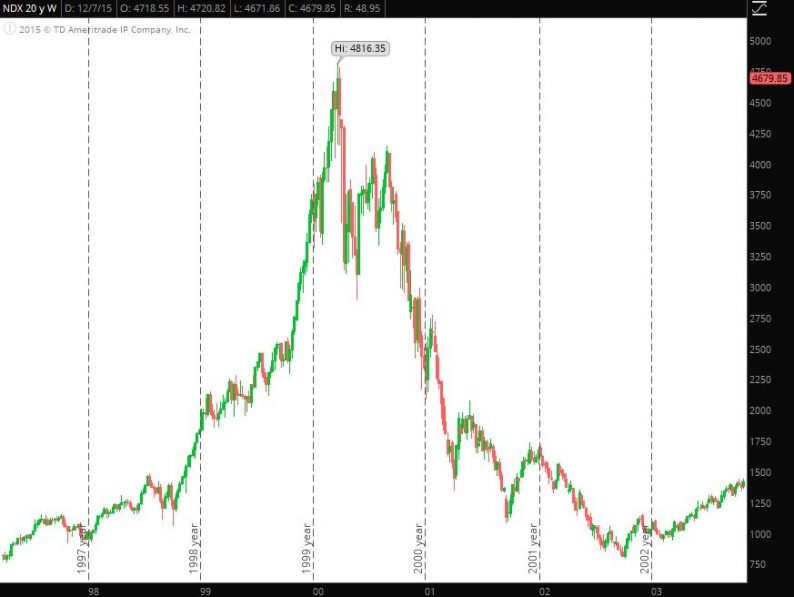

Industrial production jumped 1.1% in February led by manufacturing. The Fed’s Industrial Production and Capacity Utilization report shows a 1.1 percent gain, well over the Econoday consensus of 0.4 percent. Details Another One-Month Wonder? Surges have typically been one-month wonders. Is this another one?