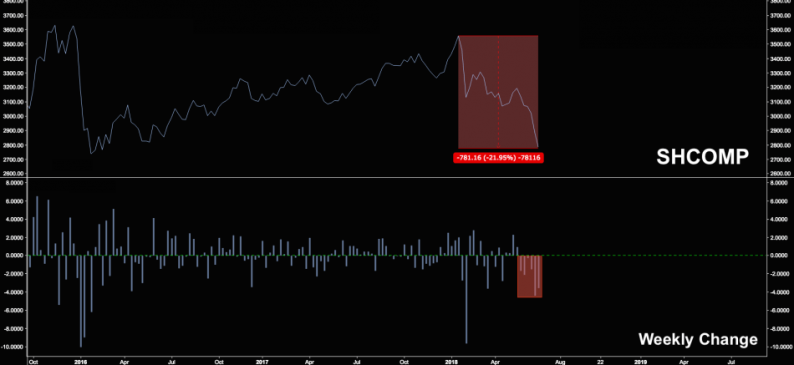

Bulletin headline summary from RanSquawk Risk tone soured in Europe as US tariffs concerns and German political instability lead all equity markets into negative territory US President Trump said he spoke to Saudi Arabia’s King Salman on raising production by

July 2, 2018