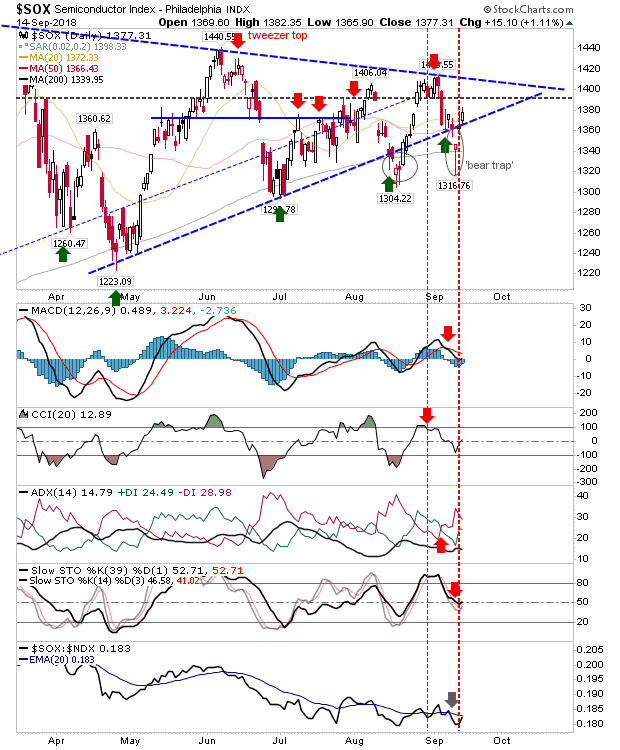

There wasn’t a whole lot to Friday’s action but two indices which were struggling a little did benefit. The Semiconductor Index gained 1% as it bounced strongly off the bullish ‘morning star’. The consolidation triangle looks to be shifting to

September 16, 2018