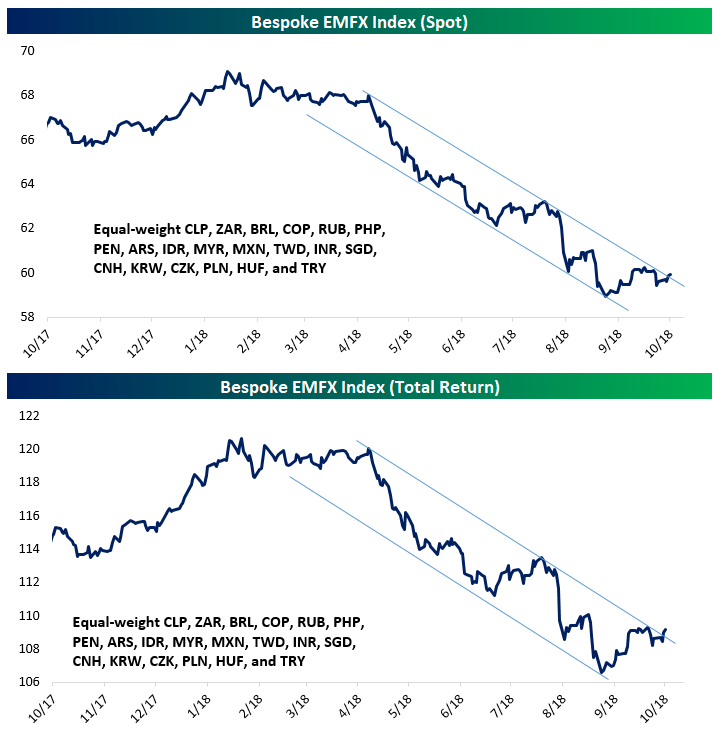

Declines in emerging market currencies and other financial markets in EM have been a big driver of investor angst so far this year. Since April 18th, our equally-weighted index of EM currency performance versus the US dollar has dropped 11.8%;

October 12, 2018