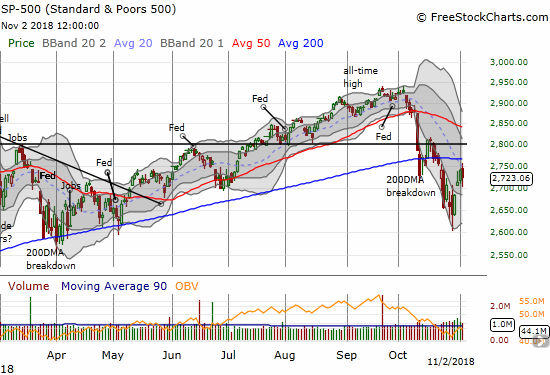

“Don’t fight the Fed” is a long-established, oft-confirmed market proverb. The Fed is indeed an incredibly powerful institution; in fact, it is perhaps the most powerful entity on the planet. It is arguably more powerful than our combined air, sea,

November 4, 2018