The EconomyLast Friday morning we received the February jobs report. Job growth once again smashed expectations, but unemployment jumped to 3.9% due to recent corporate layoffs. It is interesting to note that much of the job growth is due to

March 10, 2024

China is preparing to raise billions of dollars for its largest-ever semiconductor fund, aiming to fast-track the advancement of cutting-edge technologies in response to Washington’s worsening trade and tech war. Pexels According to Bloomberg, China’s National Integrated Circuit Industry Investment Fund is pooling

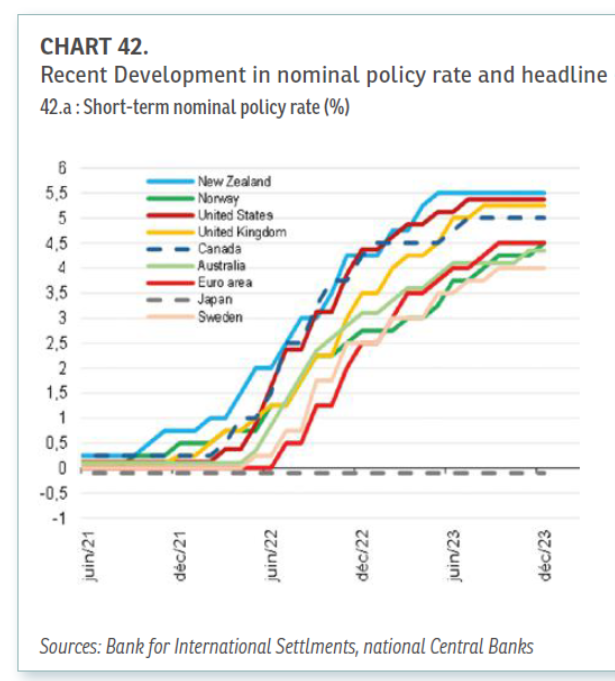

Some important charts from around the world. Source: Eurofi. Source: Eurofi. Summary: Source: Dallas Fed DGEI. CFR Monetary Policy Tracker shows whether policy is tightening or loosening in February. Source: CFR. On a related note, here’s 2s10s term spreads around the world. Source: Worldgovernmentbonds.com.More By This