A third straight week of positive digital asset inflows has fully corrected nine previous weeks of outflows for the market, according to a report from CoinShares published on July 10.

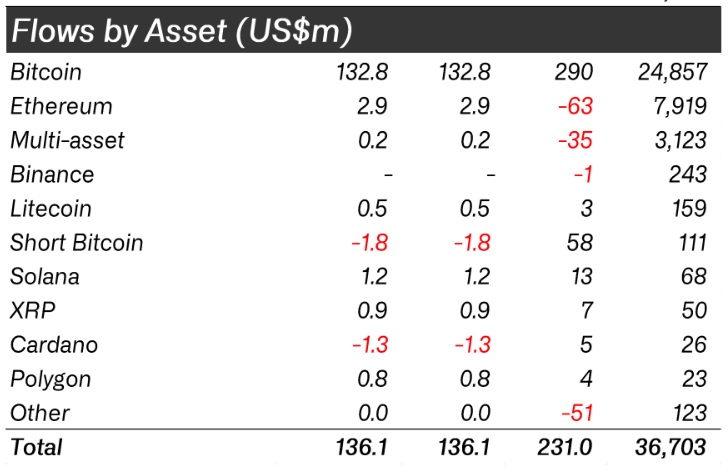

This week’s inflows registered $136 million. Bitcoin (BTC) funds continued their trend of holding the anchor position, with 98% of the inflows coming from BTC. The other 2% mostly came from Ether (ETH), multi-asset holdings, and a handful of altcoins.

This brings the last 3 consecutive weeks inflows to US$470m, fully correcting the prior 9 weeks of outflows.

Trading turnover has slowed though, which might be explained by the seasonal effects, where lower volumes are typically seen during July and August.

2/6 pic.twitter.com/4uyvrY0aRP

— CoinShares (@CoinSharesCo) July 10, 2023

Bitcoin inflows showed no signs of slowing down this past week after posting year-long highs in the previous two. As Cointelegraph previously reported, BTC inflows for last week were $123 million. This week adds $10 million, bringing the two-week inflow haul for BTC alone to $256 million.

This continues Bitcoin’s crypto market dominance by extending its total market cap from last week’s 51.46% to a reported 51.66% share as of July 11.

In other good news for hodlers, blockchain equities inflows reached a year-long high of $15 million. This more than doubled last week’s $6.8 million, which snapped a nine week outflow streak of its own, according to Coinshares.

However, there may be some indication of equilibrium on the horizon, as overall liquidity appears to be down. According to the report, trading volume has hit a “seasonal low,” imitating cycles from previous years that saw low liquidity in July and August.

Related: Bitcoin supply shock will send BTC price to $120K — Standard Chartered

Despite the continuing positive news surrounding inflows, some investors appear to be getting nervous over the lack of a clear trend.

Positive sentiment generated by the expectation that one or more companies would finally receive authorization from the U.S. government to offer BTC as a spot exchange traded fund may be tapering off as the process wears on.

There also remains an air of uncertainty as the Securities and Exchange Commission’s ongoing litigation against Binance and Coinbase continues with no clear sign as to how the courts will decide.

Leave A Comment