Major Brazilian investment bank BTG Pactual is acquiring cryptocurrency-friendly brokerage Orama DTVM as part of its strategy to expand the bank’s digital platforms.

BTG Pactual has signed an agreement to buy 100% of Orama’s shares for 500 million Brazilian reais ($98.7 million).

Announcing the news on Oct. 2, BTG Pactual said that the acquisition is part of the bank’s digital expansion strategy and offers more investment opportunities.

“We are very excited about the acquisition, which will provide Orama customers with access to the complete BTG platform”, BTG’s digital platforms partner Marcelo Flora said. The acquisition is subject to the necessary regulatory approvals from authorities including the Central Bank of Brazil, the announcement notes.

Founded in 2011, Orama is said to have nearly 18 billion reais ($3.6 billion) of assets under custody and services about 360,000 customers. Focused on the distribution of investment funds and fixed-income products, Orama has also been exploring cryptocurrency investment.

In April 2022, Orama’s wealth management arm Orama Singular launched an actively managed fund focused on digital assets. Called Block3, the fund offers multimarket investment in the cryptocurrency industry, providing exposure to various crypto assets, including Bitcoin (BTC), tokens, derivatives and others.

Related: Brazil’s crypto surge prompts central bank to tighten regulation

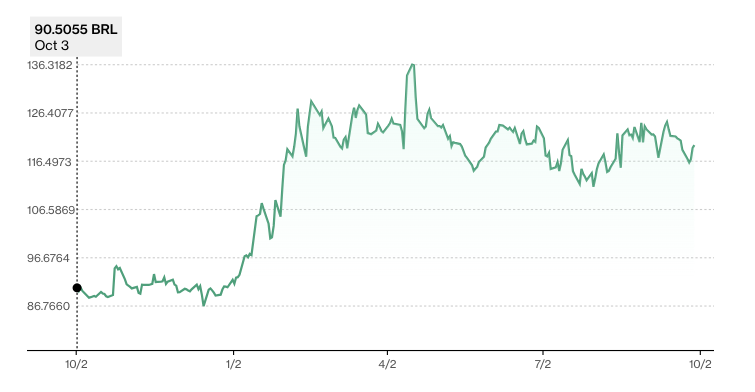

Orama’s digital asset fund has recorded a successful trend over the past year, surging more than 30% from 90.5 BRL ($17.9) in October 2022 to 118.8 BRL (23.5) in September 2023, according to data from Bloomberg.

Apart from purchasing Bitcoin-friendly Orama, BTG Pactual has been active in crypto-related ventures in recent years. In April 2023, the bank announced plans to launch BTG Dol, a new stablecoin pegged to the U.S. dollar on a 1:1 ratio, using the bank’s custody services. The bank previously launched a crypto trading app enabling customers to make direct investments in cryptocurrencies.

Magazine: Web3 Gamer: Minecraft bans Bitcoin P2E, iPhone 15 & crypto gaming, Formula E

Leave A Comment