While Bitcoin (BTC) offered the world an era of true decentralization, the introduction of centralized exchanges and custodial services has lured people away from the original premise of crypto — trustlessness and self-custody. However, the collapse of major crypto exchanges such as FTX acted as a bitter reminder of the importance of the “Not your keys, not your coins” mantra, triggering an exodus from centralized platforms to noncustodial solutions.

With most self-custody or noncustodial storage options, the private key to a user’s crypto asset is stored and controlled by the user themselves, whereas custodial services simply take those assets and give users an “I owe you” before they withdraw their assets from the platform.

Noncustodial solutions align better with the overall philosophy of crypto, but they are not foolproof. Hardware wallets, a prominent method of “cold storage,” allow for offline storage of crypto private keys. Still, they are exposed to the same risk of theft, exploitation and loss of access as a traditional physical wallet. The recent service update from hardware crypto wallet company Ledger revealed that hardware wallets can also have a “backdoor” for seed phrase recovery purposes.

Individual crypto users are still struggling with comprehending how to protect their private keys to ensure that their assets remain safe and secure. Moreover, Web3-native teams face even greater difficulty in accessing shared funds due to the limitations of existing multisignature (multisig) solutions. In the last several years, multi-party computation (MPC) has emerged as the gold standard in secure self-custody, but the way in which it is deployed still has some significant security vulnerabilities. The custody infrastructure segment of the crypto industry continues to evolve to meet crypto companies’ ever more rigorous demands to effectively manage and secure their collective crypto assets.

How does multiparty computation work?

Multiparty computation (MPC) allows multiple parties to compute a function on an input, without revealing the input itself. With respect to crypto self-custody, MPC nodes work collectively together to provide a public key and signature functionality without ever possessing or materializing a private key.

With most implementations of MPC, ultimate control over users’ assets in the form of signing authority remains in the hands of a trusted third party, such as a custodian or exchange. As long as MPC nodes are under the control of a single organization, there is always the risk of external hacks and internal collusion.

Qredo, a noncustodial digital asset management platform that’s currently managing $4 billion in monthly transactions, expands upon the MPC concept to introduce the better-protected distributed multiparty computation (dMPC). Qredo’s dMPC distributes independently held private key shares across multiple nodes housed in a security-hardened tier 4 data center. Thanks to the network migration to Trusted Execution Environments, Qredo is not able to access the key shares. As Qredo network becomes further decentralized, so too does MPC computation, ensuring that sensitive private key material is not under the control of any single entity and reducing the risk of theft or loss.

Through this process, Qredo provides enhanced security and aims to minimize points of vulnerability that come with single-location private keys.

Secure self-custody for teams

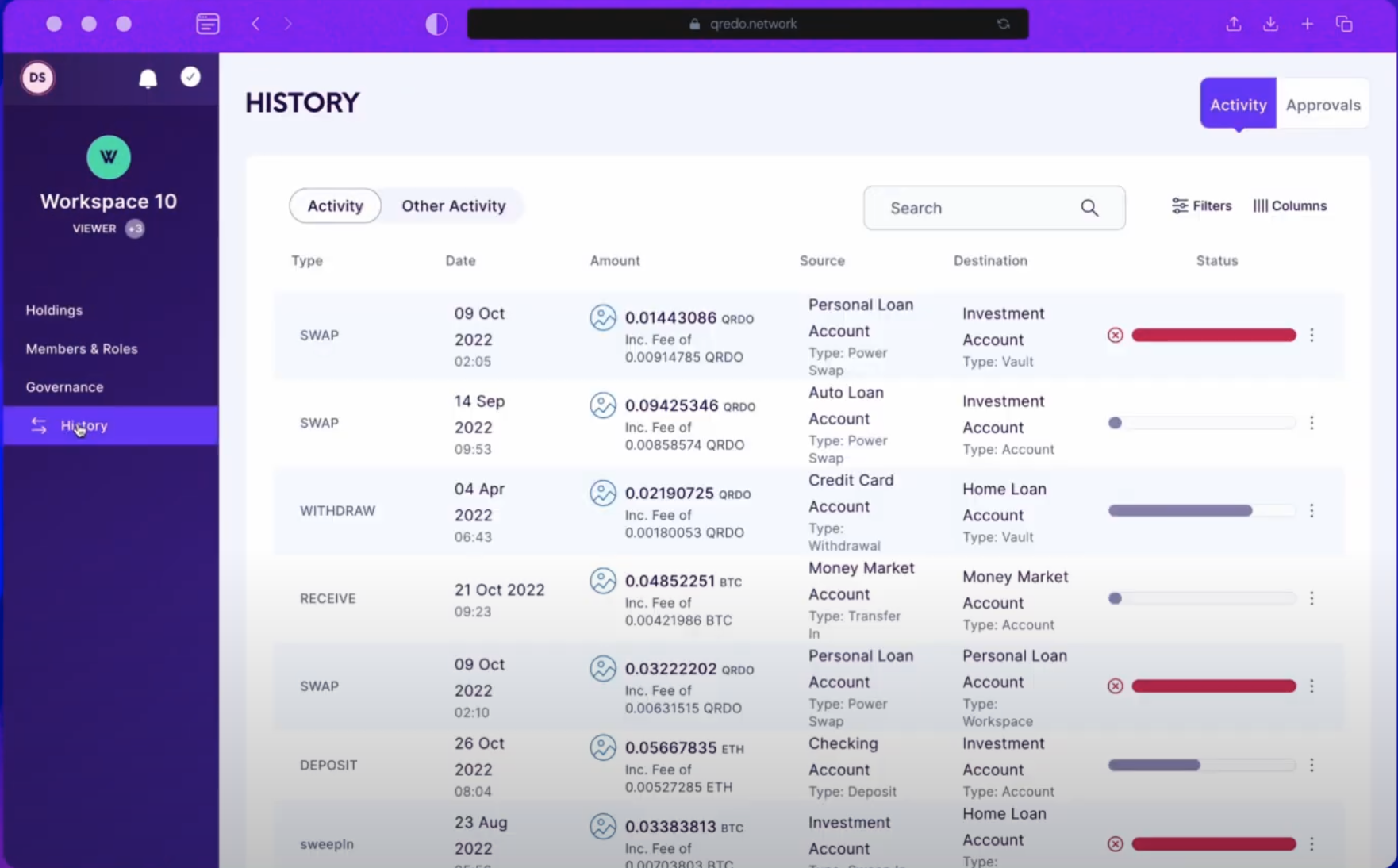

Qredo recently unveiled a sweeping upgrade to its self-custody wallet platform, providing teams with more granular control over their assets, easier navigation, and streamlined onboarding. The platform offers a role-based access model that allows for the configuration of different profiles, such as Admin and Viewer, for better governance. Workspaces allow organizations to scale their governance policies across funds, lines of business or departments. Portfolios enable the creation of sub-accounts, and Whitelists improve security by allowing teams to tightly control where funds can be sent.

The new Qredo Station also presents a simplified interface that allows users to manage their QRDO tokens.

Users can see transactions across different accounts on one screen. Source: Qredo

“The Qredo platform brings enterprise-grade crypto security to all users,” Qredo chief operating officer Josh Goodbody summarized, adding:

“This is something the space is crying out for — secure self-custody of assets, with instant deployment across numerous blockchains. New Qredo makes secure on-chain custody, with multi-factor authentication, a reality for everyone.”

Enhancing DeFi adoption

Qredo’s customizable governance system allows for a better user experience in managing digital assets while also improving on the MPC security model. Together, these two advancements alone are paving the way for a better, more secure future in crypto self-custody.

Qredo lets teams of any size collaborate flexibly and efficiently and also offers integrations with the leading Web3 wallets, including MetaMask Institutional, WalletConnect and Sui Wallet, giving users access to hundreds of digital assets across blockchains.

An $80 million Series A raise in early 2022 has enabled Qredo to continue to evolve its platform and work toward its long-term objective of improving MPC yet again, from “distributed” to fully “decentralized” MPC. With the goal of facilitating the widespread adoption of secure crypto self-custody in DeFi for individuals and teams alike, Qredo continues to operate at the bleeding edge of innovation.

Learn more about

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Leave A Comment