Ether (ETH) price surged by 31.3% from March 10 to March 18, coinciding with the U.S. Federal Reserve’s injection of $300 billion to address the insolvency of Silicon Valley Bank.. Since then, Ether’s price consistently maintained a daily closing price above $1,600.

However, investors are now casting doubt on Ether’s ability to sustain this support level, given the prevailing bearish sentiment in the cryptocurrency space and declining metrics on the Ethereum network.

Over the past six months, the cryptocurrency sector has been plagued by negative developments. Notably, the Digital Currency Group (DCG), the owner of Grayscale mutual fund manager, has faced financial troubles. Concerns are mounting that a portion of the $4.8 billion worth of ETH deposits held in the Grayscale Ethereum Trust could be liquidated to address DCG’s debts.

Furthermore, two major global exchanges, Binance and Coinbase, are currently facing legal action from the U.S. Securities and Exchange Commission (SEC). Additionally, investors initially expressed excitement when several requests for futures-based Ether exchange-traded funds (ETFs) surfaced in early August. However, it’s important to note that these instruments, unlike spot ETFs, would not involve actual ETH coins if approved.

On-chain metrics point to declining demand

Aside from a handful of unfavorable market conditions, Ethereum’s on-chain metrics point to a stagnation in demand, both in terms of ETH investments and smart contract transactions.

Part of the lack of investor interest can be attributed to the fact that Ethereum’s average transaction fee has remained above $4 for the past six months. Consequently, despite fluctuations in network staking metrics, there appears to be no increase in the total number of investors when using the $1,000 threshold as a proxy.

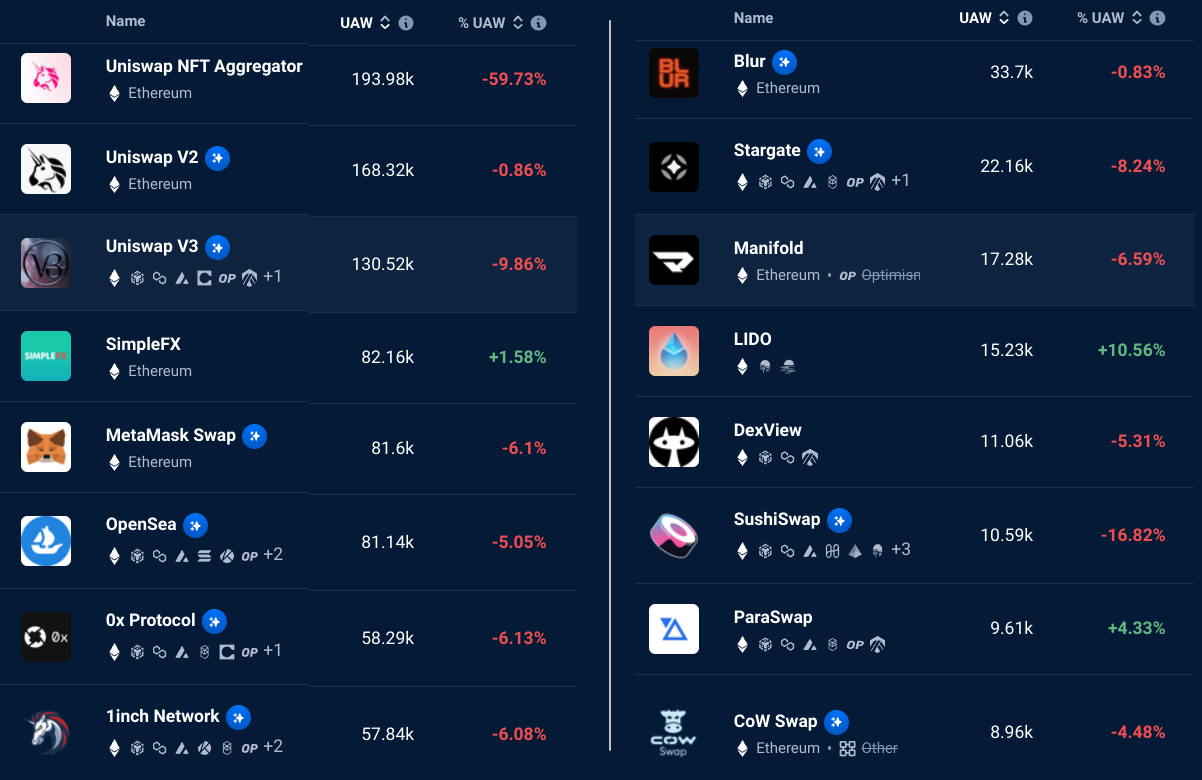

Moreover, data on decentralized application (DApps) activity on the Ethereum network corroborates the notion of a dearth of new users.

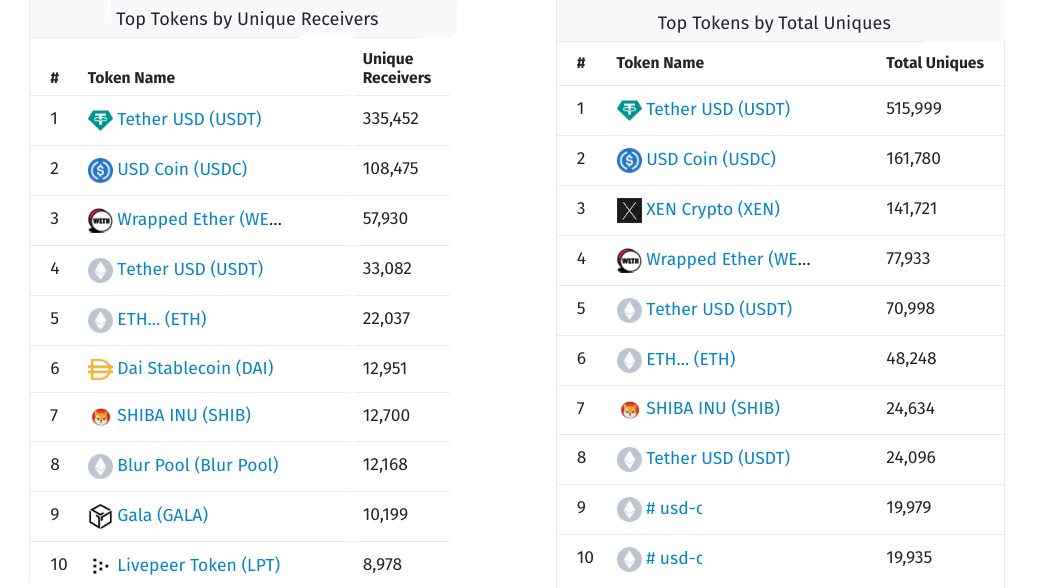

From cryptocurrency games to decentralized exchanges, NFT marketplaces, and Web3 services, every sector has witnessed a decline in the number of active users, according to DappRadar. Regarding token activity on the network, with the exception of stablecoins and wrapped ETH, no project has recorded more than 13,000 unique receiver addresses over the past week.

Competitors are benefiting from the stablecoin volumes

In the meantime, recent developments have left Ethereum enthusiasts somewhat disappointed. Visa, the payment processor, has incorporated Solana blockchain settlement capabilities, following Circle USD (USDC) introducing native accounts and transfers on the Base chain. In response, Coinbase exchange promptly announced its intention to assist partners in converting old, bridged versions of USDC to the new format.

Furthermore, Rune Christensen, co-founder of MakerDAO, has put forth a proposal to develop the decentralized finance project’s upcoming native chain based on Solana’s codebase, despite its longstanding affiliation with Ethereum.

In light of the prevailing bearish sentiment in the cryptocurrency market, which includes exchanges facing legal challenges from the SEC and diminishing interest in cryptocurrencies, as indicated by the latest Google Trends data, the likelihood of Ether’s price dipping below the $1,600 support level has increased.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Leave A Comment