As people become accustomed to traditional, online-only banking, crypto innovators are building decentralized solutions that could radically change everyday finance.

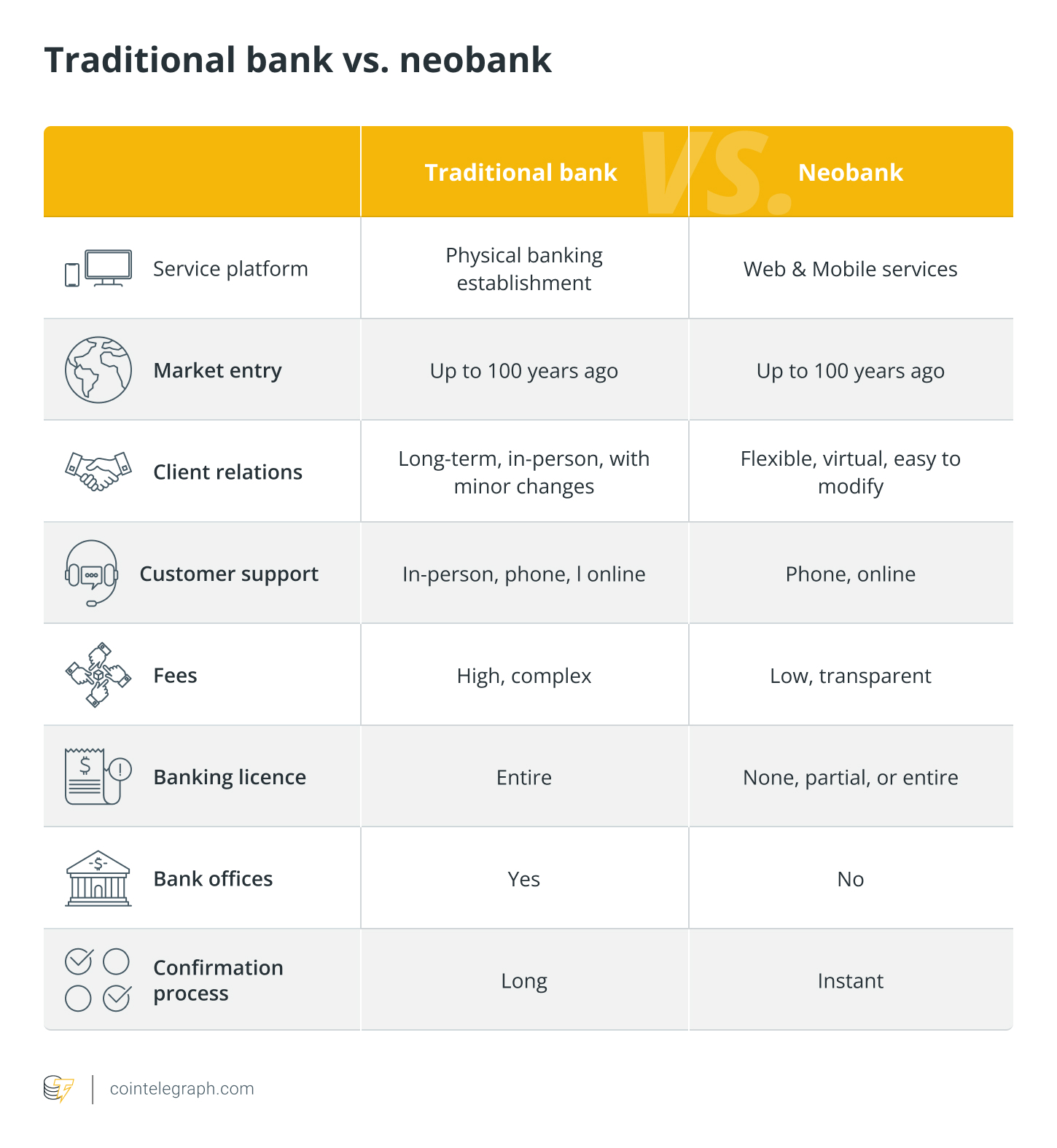

A quick Google search of the term “neobank” will bring up the 2007–2009 crisis for a good reason. In the aftermath of the global crisis, entrepreneurs decided that it was possible and viable for startups to build fully online, more advanced and risk-averse financial systems without tethering them to physical locations. What else is special about them?

Neobanks, explainedIn the United Kingdom, these fully online banks are called “challenger banks” because they have forced traditional banks to rethink their core practices and compete more actively with inventive fintech startups. The term “neobank” itself only emerged around 2016, and today, there are more than 300 of them, the majority of which are profitable.The new banking paradigms introduced by fintech startups have benefited the general public and made the financial industry less monopolistic and exclusionary. Neobanks have enabled people to open personal accounts with little effort through advances in KYC/AML technology and stronger verification standards.

In addition, online banks often offer all the features of traditional banks, and in many cases, even more, such as low-cost loans, cash back, or international and local transfers.

What neobanks are missing

However, the way neobanks achieve their flexibility is still heavily dependent on the existence of banks with physical locations and core infrastructure. Most neobanks create their products through collaborations and integrations with traditional banks, which makes them lack independence and resilience.

On a note as important as features or reliance on third parties, neobanks are centralized institutions, just like their counterparts. In today’s financial landscape, where participants increasingly lean toward the idea of distributed, decentralized systems, even the current state of neobanking may not be enough to shape the future of finance.

Can DeFi be a solution?

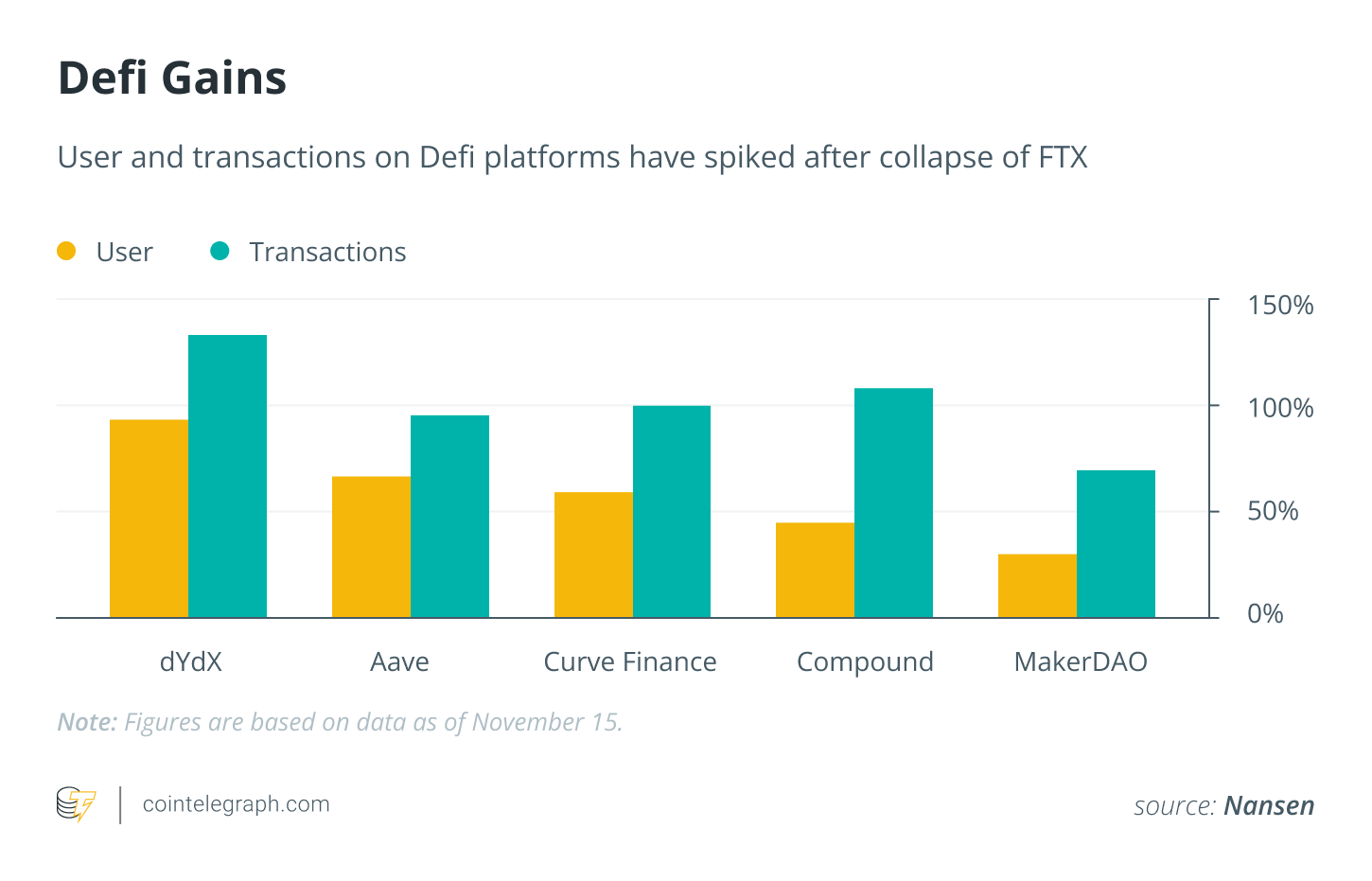

The use of decentralized finance (DeFi) products and participation in their ecosystems skyrocketed after the FTX collapse and other events. Some sources reported a 24% increase in total transaction volume on decentralized exchanges, while key DeFi protocols such as Curve and Aave saw a 60% to 70% increase in users.

As crypto enthusiasts began moving toward self-custodial wallets and fully on-chain tools, blockchain developers became more persistent in working on new DeFi platforms with features equivalent to those in centralized products.

At the same time, community-driven DeFi protocols began to launch more powerful staking mechanisms and reliable lending solutions, new user incentives, tokens representing real-world assets and more to new crypto enthusiasts.

While regulations are not always clear and the integrity of DeFi protocols’ security systems is still widely questioned due to numerous large-scale hacks in recent years, the achievements of the DeFi community have been highly inspiring and thought-provoking.

With this in mind, could the convergence of decentralized financial paradigms and novel online banks make a difference in the financial industry?

Bridging the gap between neobanking and DeFi

Until recently, an often overlooked idea in this new financial landscape was the use of cryptocurrency in online banking. Today, several neobanks like Revolut already have their crypto-feature sections, where tokens can be bought and sold by any user, putting such startups at the intersection of TradFi and DeFi.

It took some time for the first crypto-enabled online banks to build the necessary infrastructure to handle assets on a blockchain. Today, numerous tools exist for native crypto integration into centralized platforms, and crypto-powered product launches are much easier for different companies.

However, the plain integration of crypto services for buying, selling and trading tokens will not be sufficient in the financial services environment, whose members now tend to expect further decentralized and full-featured blockchain applications. Neobanking is already more accessible for people than traditional banking, where opening an account and getting used to its processes can be a burden.

As neobanks begin to incorporate self-custodial solutions and become more DeFi protocol-like, the security, resilience, user satisfaction and convenience of the platform, as well as the accessibility of banking itself, can be significantly enhanced.

Finding a common CeFi-DeFi ground

The aftermath of the downfalls of FTX, Celsius and Terra made a sea of crypto fanatics grind their teeth and move to fully on-chain platforms, but an efficient transition to a decentralized finance financial future still requires fiat operations. One must find a middle ground — a limbo between CeFi and DeFi.

The solution to finding such a place may be a hybrid future, where online banks become flexible enough to offer both sides of the equation while maintaining a solid layer of “glue” to hold them together. One part of a crypto-driven neobank can act as a fiat on- and off-ramp, while the other part opens the door to the vast world of DeFi for the user. When described, this system may sound like a centralized exchange resembling Coinbase or Binance, but one must remember that these services are nowhere close to being operational internet banks.

A hybrid financial future

A hybrid future, where all the core products from both the traditional and decentralized spaces are available through one unified interface, is emerging. A place where the average person and the expert crypto-yield hunter can equally and competently pursue their personal financial needs, and the regulations surrounding this place work both ways.

Can new fintech startups help pave the way for a hybrid future?

Kirthana Devaser is an economist turned financial writer and Web3 speaker. She firmly believes in using technology for good and that Web3 will drive meaningful change and build a better tomorrow for all. Currently, Kirthana serves as the content and copy manager at XGo, where she oversees and champions all things content and brand identity across the company.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Leave A Comment