Entering the “token era” remains a significant leap into uncharted territory for companies, but this doesn’t have to be the case. Brickken, an up-and-coming tokenizing solution, now helps companies to create digital tokens backed by real-world assets –– with zero downtime and instant execution.

Cryptocurrencies dominated the 2010s — and so far, artificial intelligence (AI) is the theme of the 2020s. But there’s another buzzword that’s gaining traction, too: tokenization.

While there have been major trade innovations over recent decades, New York remains rooted in tradition, with the stock market only open between 9.30 am and 4 pm on weekdays. That’s at odds with the 24/7, digital nature of the 21st-century economy — a world where business never sleeps and TikTok posts carry more influence than newspaper columns.

To match that speed of life, up-and-coming Web3 companies looking to capitalize on current trends can confront the limitations of old-fashioned fundraising models. Barriers can stand in the way of accessing capital, stymying growth and preventing projects from achieving their full potential.

But tokenization is being touted as a way of navigating this — allowing entrepreneurs to tap into a wider pool of investors, expand more quickly and offer levels of transparency that startups stuck in an analog world cannot match.

Moreover, tokenization democratizes investments for individuals, enhancing liquidity and enabling participation in governance, empowering them with previously inaccessible financial opportunities and decision-making influence.

Digital assets aren’t the only things that can be tokenized. Imagine transforming real-world assets like property, fine art, precious metals and even top-shelf whiskey into tokens! As the world ventures further into the future, tokenization can pave the way for developers to unleash a world of products, services and DApps that can completely reshape peoples’ everyday lives. Think about it – voting applications are just the tip of the iceberg!

The challenges of the “token era”

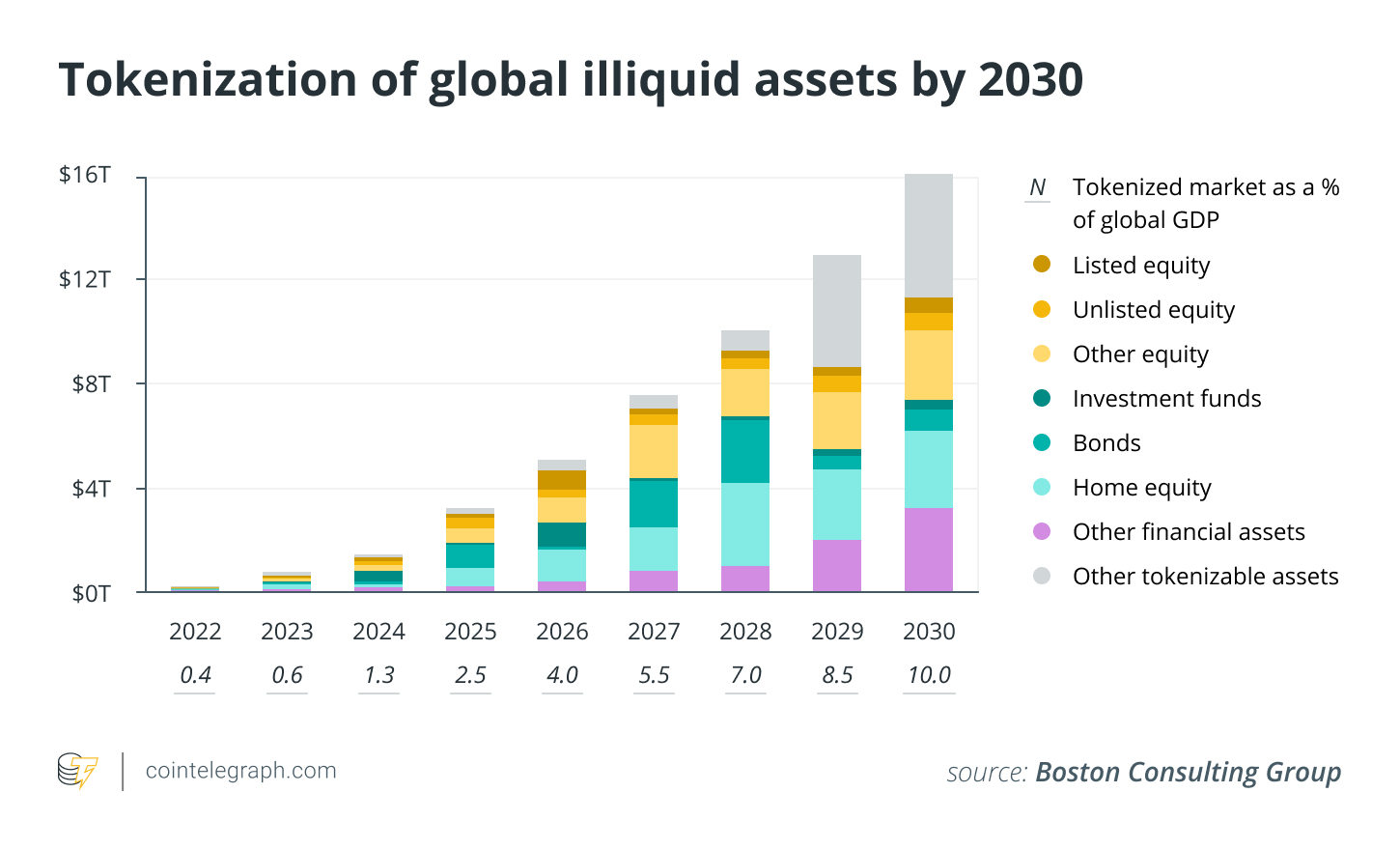

Given these benefits, it is no wonder the Boston Consulting Group recently “conservatively” estimated that the total amount of tokenized illiquid assets could reach $16.1 trillion by the end of the decade, representing “a large chunk of the world’s wealth today” –– seismic changes lie ahead.

But entering this “token era” can still be a massive leap into the unknown for cutting-edge companies — and a daunting process. Among the benefits of tokenizing real-world assets, there is a significant challenge –– how can users assess the quality and credibility of token issuers and projects?

The lack of a standardized regulatory framework and the relative newness of blockchain technology makes it difficult for investors to distinguish between legitimate projects and potential scams. This uncertainty undermines investor confidence, dampening trust and reducing investment flows into the ecosystem.

Without reliable mechanisms to verify the authenticity of token issuers and their projects’ viability, investors risk falling victim to fraudulent schemes or ill-conceived ventures. The lack of transparency in the fundraising process exacerbates these concerns.

As a result, potential investors may be reluctant to participate in token sales or investment opportunities, hindering the growth and potential of the blockchain economy.

Building trust in tokenized assets

Digital asset management platform  recognizes this pressing challenge and takes a proactive approach to address it. By offering a comprehensive platform that emphasizes transparency, compliance and accountability, Brickken helps bridge the trust gap between token issuers and investors.

recognizes this pressing challenge and takes a proactive approach to address it. By offering a comprehensive platform that emphasizes transparency, compliance and accountability, Brickken helps bridge the trust gap between token issuers and investors.

Through its robust verification processes and adherence to regulatory standards, Brickken ensures that only credible and legitimate projects gain access to its ecosystem.

Additionally, Brickken has developed its own suite of innovative tools. These include real-time analytics, token workflow automation and an automated cap table management system that provides real-time updates on holders and their respective holdings. The platform also offers automatic dividend payouts, where token issuers deposit certain tokens into an escrow account, allowing investors to claim dividends in accordance with their ownership.

Brickken services. Source:

Brickken’s emphasis on issuer-holder communication and reporting tools enables token issuers to provide transparent updates on their project’s progress, financial health and compliance status. Thanks to these data points, investors can make more informed decisions about where to allocate their resources.

Additionally, the process of reconciliation becomes a one click concept with tokenization, blockchain and the Brickken token suite. Investments trigger the token purchase, and dividens are paid based on weight. This means there no need for any comparisons or additional data entry review as these transactions happen on chain.

Free consultations are also available for tokenholders and businesses interested in beginning this journey.

Empowering global tokenization

Brickken’s CFO Pedro Sandoval believes “the composable nature of blockchain-based infrastructure will drive the next generation of asset management”:

“The versatility of tokenized assets, with their ability to integrate with everything from global liquidity to financial and social applications built worldwide, will revolutionize how assets and investors are managed.”

Brickken’s primary mission is to harness blockchain technology and deliver decentralized fundraising — allowing firms and investors everywhere to tokenize real-world assets on a global scale through a standardized process.

Learn more about

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Leave A Comment