A high level of diversification is essential in the crypto market. An automated trading platform is helping traders build balanced portfolios with built-in risk management tools.

Many investors find cryptocurrencies attractive because of their high volatility, which opens the door to returns that are difficult to achieve in traditional finance. However, this is a double-edged sword, as volatility also implies much higher risk.

The best way to reduce the volatility risk of individual digital currencies while still leveraging the wild price movements in the crypto market is to consider a diversified approach. Building a diversified crypto portfolio can reduce the risk while offering more stable returns.

However, while thousands of digital assets are available, crypto investors are looking to build a portfolio that reflects understanding of the crypto market and has unique characteristics.

There are two main things to consider before starting a crypto portfolio. First, performing fundamental and technical analysis on crypto assets is more challenging than on traditional assets like stocks, foreign exchange pairs or commodities. The crypto market is still an emerging industry, and it’s hard to predict major events that will affect it.

The lack of a clear regulatory framework across major jurisdictions and the rapid development of new subsectors such as nonfungible tokens (NFTs) or decentralized finance (DeFi) bring unique aspects to the crypto world. Some of these innovations are impactful but hard to predict. For example, who could have anticipated that the launch of Compound would spark the DeFi summer so quickly? Then there are the innovations that fail when they think the party will last, as with the TerraUSD (UST) and Terra (LUNA) collapse.

This element of surprise can quickly change any general trend and defy any technical analysis logic that happens more often than with stocks or forex pairs.

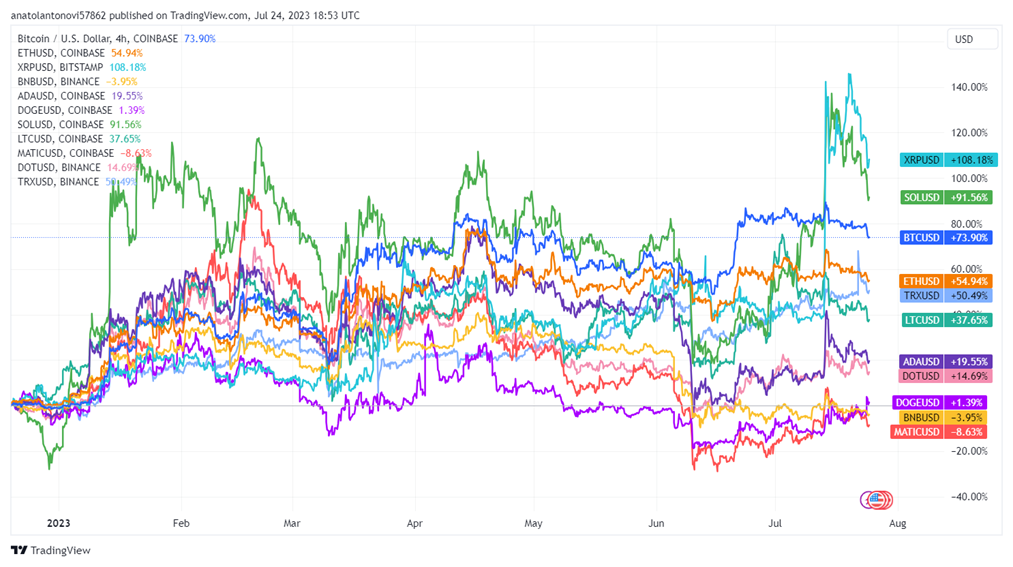

The second thing to know about the crypto market is that while it’s somewhat independent of traditional assets, its components show a very high correlation, making diversification a bit more complicated. The truth is that most crypto assets follow Bitcoin (BTC) over the long term.

Performance of the top-10 altcoins, excluding stablecoins, compared to Bitcoin in 2023. Source: TradingView

While the returns of these cryptocurrencies spread over a wide range and more extended time frames, which is suitable for diversification, short-term moves often overlap. That’s why it’s best to consider building a crypto portfolio with various subsectors and a longer-term goal.

This automated trading platform supports diversified portfolio building

Investors can diversify their crypto market exposure by manually purchasing multiple digital currencies through centralized or decentralized exchanges. However, it is difficult to track all these assets, and unexpected events can catch investors off guard.

A more efficient way would be to build a crypto portfolio with the help of an automated crypto trading platform like TradeSanta. It enables users to develop their trading bots, implement existing ones or mirror the strategies of successful traders.

Building a crypto portfolio with TradeSanta can protect investors from many risks. The platform supports multiple algorithmic strategies and trading bots that can do most of the trading without human intervention, eliminating psychological pressure risk. On top of that, users can customize the bots to include risk management features, such as stop loss and take profit, which can take portfolio management to another level. Additionally, TradeSanta has the option to apply more advanced tools such as martingale for order volume, TradingView signals, and custom TradingView indicators. Moreover, this trading bot offers trailing stop loss and trailing take profit options to further enhance their trading experience.

Kris Vlas, TradeSanta’s partnership manager, explained:

“TradeSanta opens doors for traders of all backgrounds, empowering them to navigate the crypto market easily. Our commitment to simplicity and continuous improvement ensures that automated trading remains accessible to all.”

TradeSanta’s users can connect their customized bots directly to their preferred crypto exchange via API keys. TradeSanta’s bots are compatible with accounts on Binance, Kraken, Coinbase, Bybit, Huobi, OKX and other major exchanges. However, for more efficient portfolio management, TradeSanta offers a proprietary trading terminal, which is intuitive. Traders can manage all their portfolios and positions in one place.

TradeSanta supports over 3,700 cryptocurrencies, enabling investors to build a diversified portfolio and incorporate the best risk management techniques. The platform can be used in bullish and bearish markets to help users trade successfully in different market conditions.

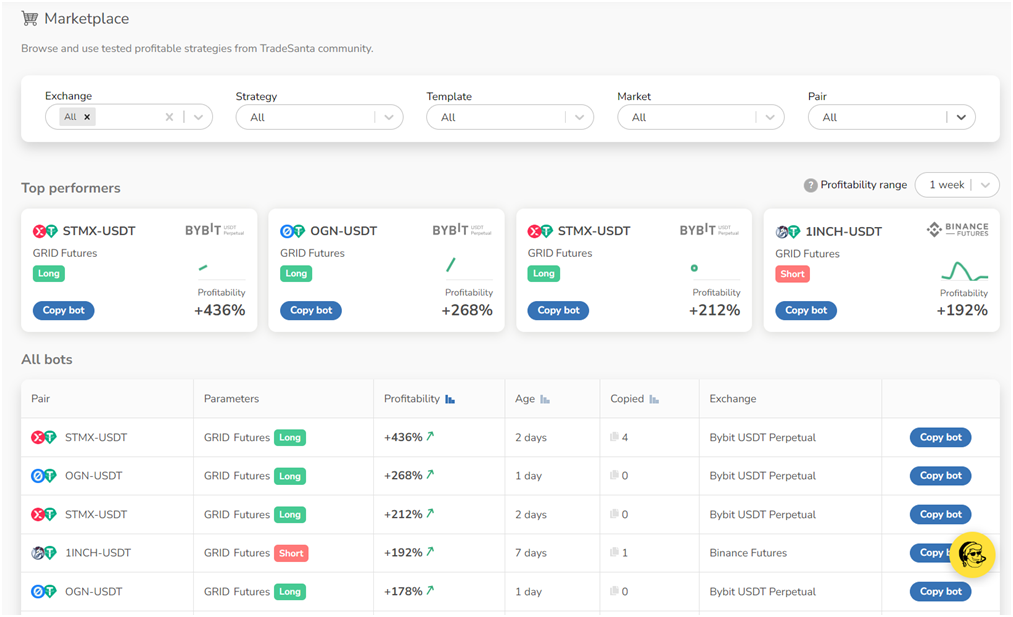

Another of TradeSanta’s tools is its marketplace, which shows the best-performing bots that users can copy with a single click. Users can monitor the profitability of the bots over the last 24 hours, three days, one week or one month. It can help investors rebalance their crypto portfolio by adding some of the best-performing pairs and strategies to increase profitability.

Source: TradeSanta

Building a crypto portfolio with TradeSanta helps traders automate the trading and allocation processes, reduce human error, implement risk management features, take advantage of bullish and bearish markets and replicate better trading strategies. This approach enables crypto investors to implement proper diversification, which is essential to navigate the complex world of crypto.

Learn more about

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Leave A Comment