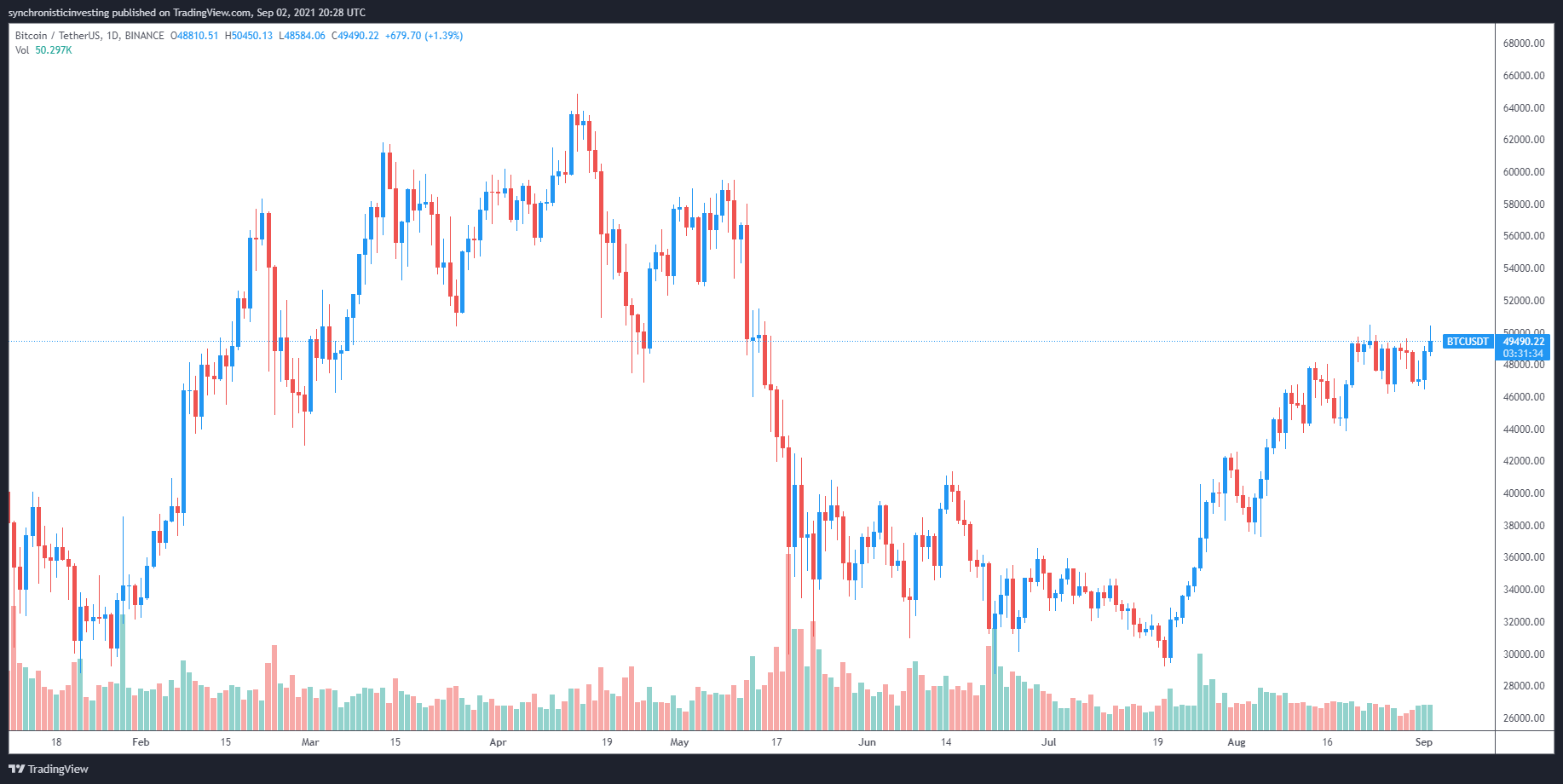

The crypto market is back in high spirits on Sept. 2 after Bitcoin price briefly tapped the $50,000 level in the early morning trading session. The move above the key resistance level came as industry insiders hinted that major companies and institutional investors hinted that recent Bitcoin purchases would soon be disclosed in public documents.

Additional bullish news came after Vast Bank announced that it had become the first U.S. bank to allow customers to buy, sell and hold Bitcoin (BTC) directly in their checking accounts.

Bitcoin finally broke out of resistance

This latest move from Bitcoin managed to break above the bottom trendline of the ascending channel and according to Rekt Capital, a pseudonymous crypto analyst on Twitter, BTC needs to test $51,000 before the market has a better idea of whether $50,000 will hold as support.

#BTC recently broke a Lower High resistance (blue)

BTC needs to successfully retest this blue diagonal as support if it is to springboard to ~$51,000 next$BTC #Crypto #Bitcoin pic.twitter.com/HXxZmRpKkY

— Rekt Capital (@rektcapital) September 2, 2021

Based on the chart provided, Rekt Capital warned to be on the lookout for a retest of the support line which could see the price drop as low as $48,500.

Rejection at overhead resistance could prompt a drop to $41,300

Further insight into Bitcoin’s price action came from Crypto Chase, who is looking at the $56,000 price level as a signal to go long.

Potential longs. Green box is a rough idea of where I’d enter. First scenario is S/R flip, second scenario is simply bidding a level.

Either way I’m looking to get long towards 56K.

Lose blue and I’d prob flip bear till 41.3K. pic.twitter.com/p7KZqqgWTv

— Crypto Chase (@Crypto_Chase) September 2, 2021

While the trader did not indicate which scenario is most likely to develop, he did point out that a support/resistance flip of the zone highlighted in blue would play a role in determining the direction of the trend.

Related: BTC price returns to $50K as Bitcoin bears lose $450M in daily liquidations

Bulls need a close above $51,000

Cointelegraph contributor Michaël van de Poppe also suggested that Bitcoin needed to secure a close above $51,000 in order to see continuation.

To me, #Bitcoin still has to break that $51K level here for further bullish momentum.

Overall, sideways action suits #altcoins nonetheless. pic.twitter.com/acpIDaBZOw

— Michaël van de Poppe (@CryptoMichNL) September 2, 2021

As highlighted in the chart provided above, the $51,000 level was a significant price level during BTC’s run-up in early in 2021, so a breakout above this level would need to be seen in order to confirm that the trend change is confirmed.

Failure to break out above this level could result in further consolidation for BTC and this would bode well for altcoins which typically pack on significant gains when Bitcoin price trades sideways.

The overall cryptocurrency market cap now stands at $2.227 trillion and Bitcoin’s dominance rate is 41.8%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment