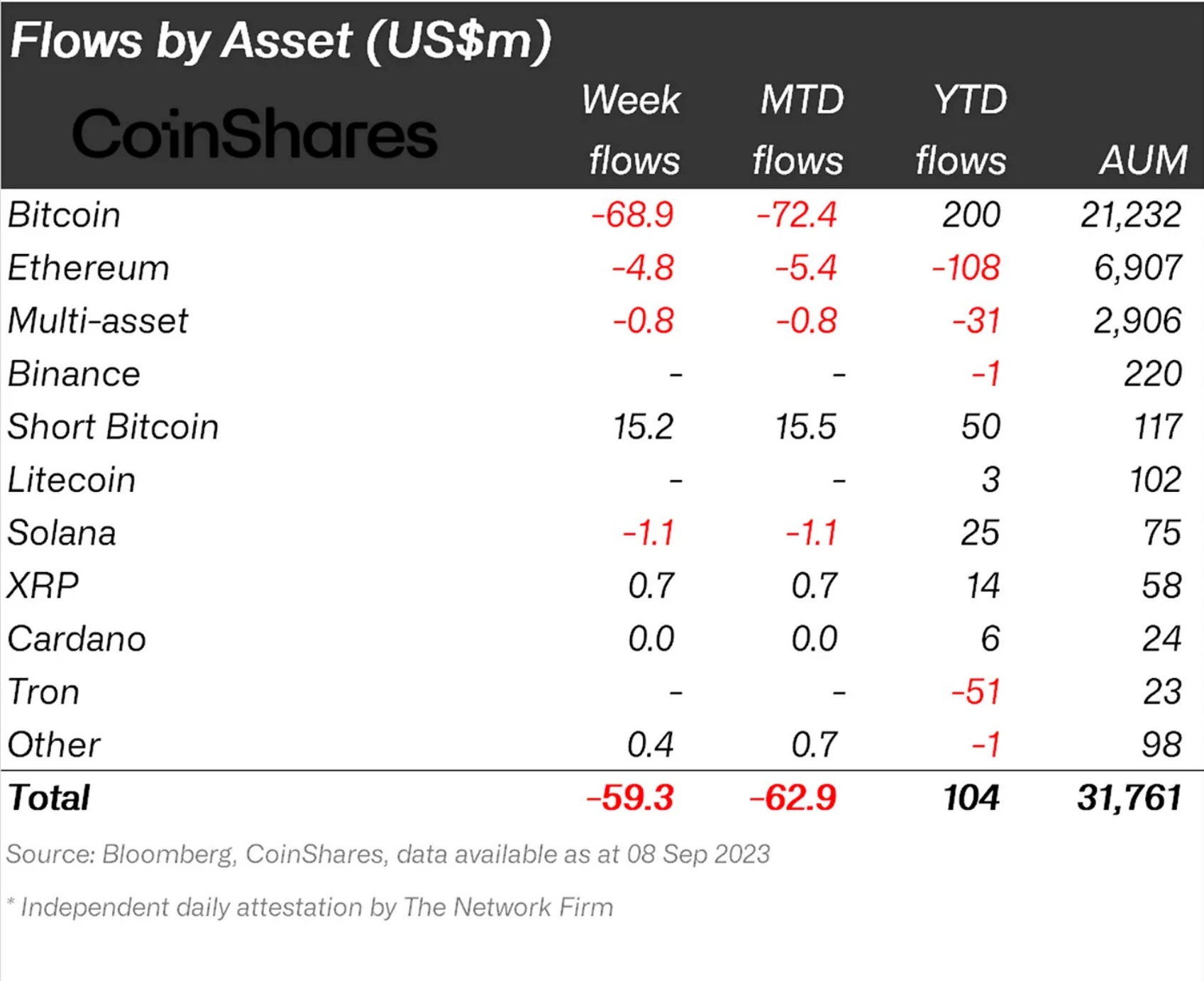

Cryptocurrency asset outflows for the week of Sep. 3 through 9 totalled $59.3 million, bringing the current run to $249 million over four consecutive weeks.

Bitcoin experienced the bulk of activity last week, with its $68.9 million in outflows offset by Short Bitcoin inflows in the amount of $15.2 million and $0.7 million from XRP.

According to CoinShares, regulatory and financial markets insecurity are to blame for the streak:

“We believe continued worries over regulation of the asset class and recent dollar strength are the most likely reasons for this. Trading volumes also dropped significantly, by 73% in comparison to the prior week to just $754 million for the week.”

Last week also brought an end to Solana’s recent run. After nine weeks of inflows totalling $14.1 million and prompting CoinShares to suggest that it was “the most loved altcoin amongst investors,” Solana saw $1.1 million in outflows.

Ethereum also experienced outflows for the week, with its $4.8 million trailing a distant second behind Bitcoin’s. With its year-to-date outflows now totalling $108 million, CoinShares has labelled it the “least loved digital asset amongst ETP investors this year.”

Switzerland and Sweden also experienced significant outflows with the former losing $7.4 million and the latter another $2.3 million.

Expert analysts are predicting a continuation to Bitcoin’s slump with some expecting the coin to reach as low as $20K. This negative sentiment could contribute to further outflows as the current four week run seems to indicate that altcoins are unlikely to upset the balance of flows one way or the other.

Related: as low as $20K

Leave A Comment