Oil prices continue to rally. “We are moving into a world where you have lower inventories, lower spare capacity and less protection for buyers,” says John Driscoll, chief strategist at JTD Energy Services. “So $100 a barrel has become more likely, whether we get there or not, it might be a little early to say,” he told CNBC on Monday. This is on the back of US sanctions on Iran due to kick in next month.

What you need to know: since its inception in February 2013, the RBC Global Energy Best Ideas List is up 36.7% compared to the S&P Global Energy Sector’s ETF at 4.2%.

Here are 3 of the firm’s best energy stock ideas vs 3 stocks that no longer make the cut:

Encana Corp (ECA)

For Gregory Pardy (Track Record & Ratings), his best idea is Encana Corporation. This is a company which produces, transports and markets natural gas, oil and natural gas liquids. This is the company with the best real estate on the block cheers Pardy. His price target: $16 (20% upside potential).

“We believe that Encana has some of the best real estate on the block when it comes to North American resource plays and possesses solid execution capability.” This includes both the Permian and Montney, along with the Duvernay and Eagle Ford.

At this point in the game, execution is key. This means its main catalysts revolve around consistently meeting quarterly production and capital spending guidance. “Our bullish stance towards Encana Corporation is predicated upon successful delivery of its five-year growth+ margin expansion plan” he concludes.

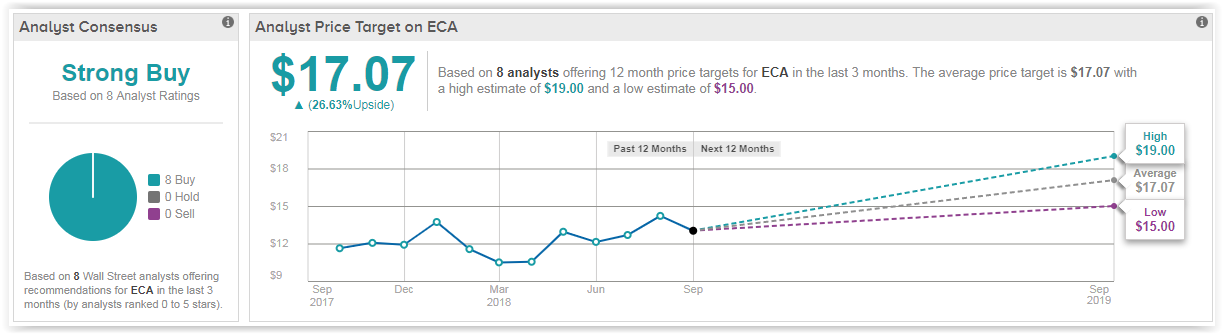

And as we can see here, the Street clearly shares Pardy’s bullish take on the stock:

View ECA Price Target & Analyst Ratings Details.

Energy Transfer Eq (ETE)

Elvira Scotto (Track Record & Ratings), one of the Top 100 analysts on TipRanks, is betting on the fortunes of Energy Transfer. She sees the stock surging 32% to hit $23. Energy Transfer Equities is about to merge with its affiliated master limited partnership Energy Transfer Partners LP (ETP)– and Scotto sees this as a savvy move.

Leave A Comment