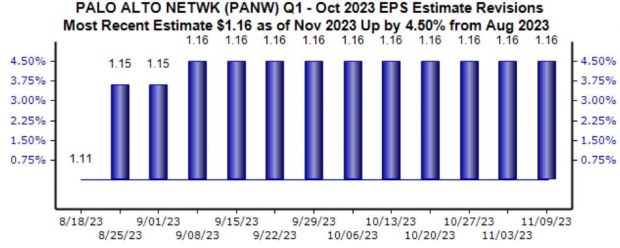

Image Source: PexelsStocks have bounced back from their late October lows, with the first few weeks of November primarily reflecting green. Of course, the Q3 earnings cycle continues to chug along, although it’ll witness a notable slowdown in the coming weeks.Still, there are many notable companies yet to report, including Palo Alto Networks (PANW), Home Depot (HD), and Target (TGT). All three are on the reporting docket for next week.Have analysts been bullish for the quarters to be reported? Let’s take a closer look.Palo Alto NetworksPalo Alto Networks is a big-time cybersecurity player, offering network security solutions to enterprises, service providers, and government entities worldwide. Shares have been big-time performers in 2023, up more than 70% amid the broader technology rebound and partly driven by artificial intelligence excitement.Analysts took their expectations for the quarter higher following its latest release in late August but have primarily left them unchanged since. Still, the value is up 4.5% over the period, also representing year-over-year growth of 40%.

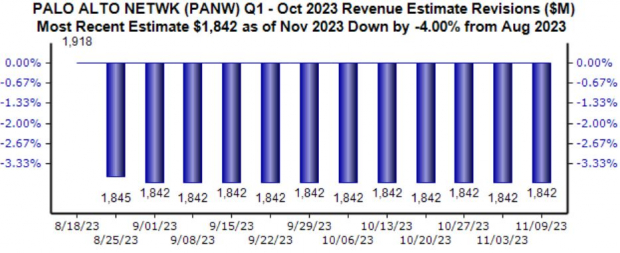

Image Source: PexelsStocks have bounced back from their late October lows, with the first few weeks of November primarily reflecting green. Of course, the Q3 earnings cycle continues to chug along, although it’ll witness a notable slowdown in the coming weeks.Still, there are many notable companies yet to report, including Palo Alto Networks (PANW), Home Depot (HD), and Target (TGT). All three are on the reporting docket for next week.Have analysts been bullish for the quarters to be reported? Let’s take a closer look.Palo Alto NetworksPalo Alto Networks is a big-time cybersecurity player, offering network security solutions to enterprises, service providers, and government entities worldwide. Shares have been big-time performers in 2023, up more than 70% amid the broader technology rebound and partly driven by artificial intelligence excitement.Analysts took their expectations for the quarter higher following its latest release in late August but have primarily left them unchanged since. Still, the value is up 4.5% over the period, also representing year-over-year growth of 40%. Image Source: Zacks Investment ResearchThe same can’t be said for top line expectations, with the $1.8 billion expected down 4% from the $1.9 billion expected in the back half of August. Growth is more than apparent, though, as the value suggests an improvement of nearly 18% from the same period last year.

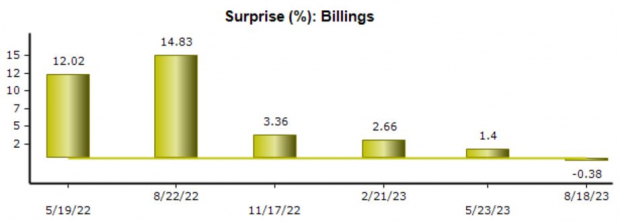

Image Source: Zacks Investment ResearchThe same can’t be said for top line expectations, with the $1.8 billion expected down 4% from the $1.9 billion expected in the back half of August. Growth is more than apparent, though, as the value suggests an improvement of nearly 18% from the same period last year. Image Source: Zacks Investment ResearchThe company provided some light guidance concerning its upcoming release following the 2023 Q4 results in August, expecting total Billings in a band of $2.05 – $2.08 billion, with the midpoint reflecting year-over-year growth of 18%.Strong Billings results would undoubtedly please investors, reflecting continued customer commitment to Palo Alto’s services while also being a leading indicator for future sales. The cybersecurity titan has primarily exceeded consensus Billings expectations but marginally fell short in its latest release, as shown below.

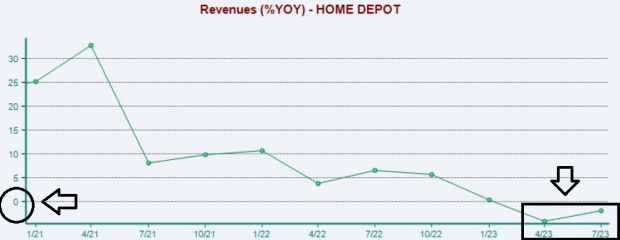

Image Source: Zacks Investment ResearchThe company provided some light guidance concerning its upcoming release following the 2023 Q4 results in August, expecting total Billings in a band of $2.05 – $2.08 billion, with the midpoint reflecting year-over-year growth of 18%.Strong Billings results would undoubtedly please investors, reflecting continued customer commitment to Palo Alto’s services while also being a leading indicator for future sales. The cybersecurity titan has primarily exceeded consensus Billings expectations but marginally fell short in its latest release, as shown below. Image Source: Zacks Investment ResearchPalo Alto reports on November 15th, after the close.Home DepotEstimates for home improvement retailer Home Depot haven’t moved much since August, with the Zacks Consensus EPS Estimate of $3.80 down a fractional 0.3% since. Our consensus revenue estimate presently stands at $37.6 billion, down a marginal 0.2% during the same period.Current consensus expectations suggest a 10% pullback in earnings and 3% lower sales compared to the year-ago period. It’s worth noting that the current consensus revenue estimate reflects the third consecutive quarter of declining year-over-year sales, following declines of -2% and -4.2% in the preceding two quarters.The company’s sales growth has stalled, as we can see below.

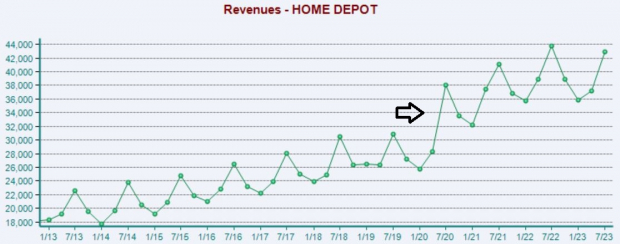

Image Source: Zacks Investment ResearchPalo Alto reports on November 15th, after the close.Home DepotEstimates for home improvement retailer Home Depot haven’t moved much since August, with the Zacks Consensus EPS Estimate of $3.80 down a fractional 0.3% since. Our consensus revenue estimate presently stands at $37.6 billion, down a marginal 0.2% during the same period.Current consensus expectations suggest a 10% pullback in earnings and 3% lower sales compared to the year-ago period. It’s worth noting that the current consensus revenue estimate reflects the third consecutive quarter of declining year-over-year sales, following declines of -2% and -4.2% in the preceding two quarters.The company’s sales growth has stalled, as we can see below. Image Source: Zacks Investment ResearchHome Depot has continued to be negatively impacted by a slowdown in big-ticket items, with a lot of demand for these larger discretionary purchases being pulled forward during COVID. Many consumers went on home improvement sprees during lockdown phases, now not needing to replace these items anytime soon.This pulled-forward demand is easier to visualize when looking at the quarterly revenues chart below, particularly near the end of 2020.

Image Source: Zacks Investment ResearchHome Depot has continued to be negatively impacted by a slowdown in big-ticket items, with a lot of demand for these larger discretionary purchases being pulled forward during COVID. Many consumers went on home improvement sprees during lockdown phases, now not needing to replace these items anytime soon.This pulled-forward demand is easier to visualize when looking at the quarterly revenues chart below, particularly near the end of 2020.  Image Source: Zacks Investment ResearchHome Depot reports on November 14th, before the open.TargetRetail giant Target has faced pressure in 2023, with shares down nearly 30% on a year-to-date basis. The company has suffered from consumers’ increasing shift from discretionary products to more ‘stapley’ items.The company’s revenue growth has similarly stalled. In fact, Target lowered its FY23 sales outlook in its latest quarterly release given recent trends, now expecting a mid-single-digit year-over-year decline.

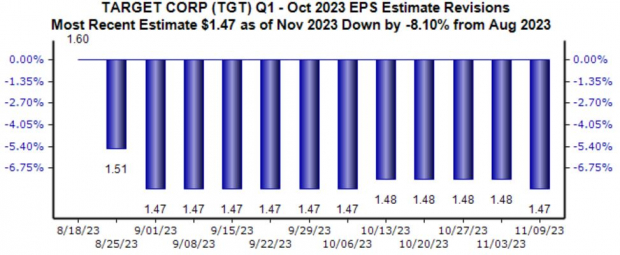

Image Source: Zacks Investment ResearchHome Depot reports on November 14th, before the open.TargetRetail giant Target has faced pressure in 2023, with shares down nearly 30% on a year-to-date basis. The company has suffered from consumers’ increasing shift from discretionary products to more ‘stapley’ items.The company’s revenue growth has similarly stalled. In fact, Target lowered its FY23 sales outlook in its latest quarterly release given recent trends, now expecting a mid-single-digit year-over-year decline. Image Source: Zacks Investment ResearchAnalysts have revised their expectations lower for the upcoming release since mid-August, with the current $1.47 Zacks Consensus EPS Estimate down 8% since and reflecting a decline of 4.5% year-over-year.Top line revisions have been similarly negative, as the $25.3 billion expected has been taken 1.3% lower during the same period.

Image Source: Zacks Investment ResearchAnalysts have revised their expectations lower for the upcoming release since mid-August, with the current $1.47 Zacks Consensus EPS Estimate down 8% since and reflecting a decline of 4.5% year-over-year.Top line revisions have been similarly negative, as the $25.3 billion expected has been taken 1.3% lower during the same period. Image Source: Zacks Investment ResearchGiven the notably weak performance in 2023, even modestly positive results surrounding inventory and discretionary demand could breathe life back into shares post-earnings. The company reports on November 15th, before the open.Bottom LineWe’re through the thick of earnings season, with many companies already delivering results.Still, we’re not entirely out of the woods yet, as we still have results from many notable companies yet to come, including those from Target, Home Depot, Palo Alto Networks, to list a few.More By This Author:3 Funds To Boost Your Portfolio On Soaring Semiconductor Sales3 Top-Ranked Stocks Breaking 52-Week HighsWill Continued Inflation Hurt Home Depot’s Q3 Earnings?

Image Source: Zacks Investment ResearchGiven the notably weak performance in 2023, even modestly positive results surrounding inventory and discretionary demand could breathe life back into shares post-earnings. The company reports on November 15th, before the open.Bottom LineWe’re through the thick of earnings season, with many companies already delivering results.Still, we’re not entirely out of the woods yet, as we still have results from many notable companies yet to come, including those from Target, Home Depot, Palo Alto Networks, to list a few.More By This Author:3 Funds To Boost Your Portfolio On Soaring Semiconductor Sales3 Top-Ranked Stocks Breaking 52-Week HighsWill Continued Inflation Hurt Home Depot’s Q3 Earnings?

Leave A Comment