We are approaching the end of the first quarter of 2018. Let us assess how the quarter unfolded for the drug/biotech sector.

The year began on a strong note for the drug/biotech sector, particularly on expectations of an increase in M&A activity. Sanofi (SNY – Free Report) and Celgene (CELG – Free Report) have already announced two deals each. Also, Pfizer (PFE – Free Report) is aggressively on the lookout for a buyer for its Consumer Healthcare unit after British firms Glaxo (GSK – Free Report) and Reckitt Benckiser Group pulled out of discussions.

After a solid run in the first two months of the first quarter, the drug/biotech sectors struggled in March, probably on broader market pressure and a few negative updates on the pipeline and regulatory front.

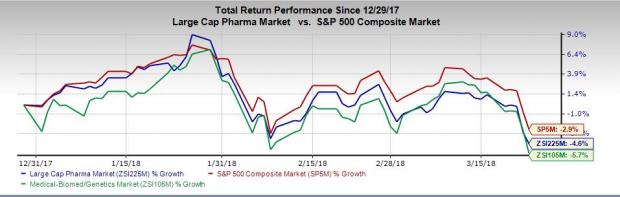

The large-cap pharma industry has declined 4.6% this year so far while the biotech industry has declined 5.7% in the same time frame. Both have underperformed the 2.9% fall for the S&P 500 in the same time frame.

However, please note that in the first two months of the year, both the sectors recorded gains and so did the S&P 500. However, all three declined in the month of March.

What Put Breaks on the Momentum?

AbbVie’s Rova-T fell short of expectations in a key lung cancer study. Dermira’s acne candidate, olumacostat glasaretil, surprisingly failed to meet the primary endpoint in two studies. Celgene was issued a refusal to file letter by the FDA for Ozanimod (multiple sclerosis) NDA and Biogen and partner AbbVie announced the voluntary decision to withdraw multiple sclerosis drug, Zinbryta from worldwide markets due to risk of liver injury. Orexigen Therapeutics meanwhile filed for bankruptcy. Solid Biosciences’ mid-stage study on lead duchenne muscular dystrophy candidate SGT-001 was put on clinical hold and Protagonist Therapeutics announced discontinuation of a mid-stage study on its key ulcerative colitis treatment.

Leave A Comment