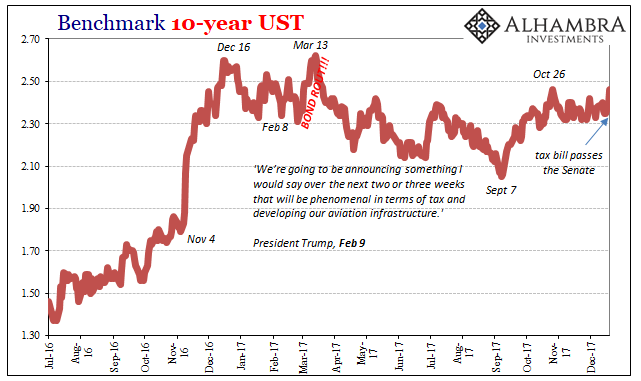

With UST yields backing up a little bit after the yield curve collapsed so far so fast, the combination of tax cut and reform “stimulus” juxtaposed with the constant, non-transitory mainstream message of recovery and growth has left us with yet another BOND ROUT!!! It has been somewhat if not completely reminiscent of earlier in 2017 when the mere promise of this kind of fiscal action triggered the same kind of talking points.

On February 8, the 10-year UST yield closed at an indicated yield of 2.34%, down substantially from “reflation” highs just weeks before. The following day, President Trump promised the most ambitious tax plan since the days of Reagan. Not only that, the White House indicated it was at most two to three weeks from materializing.

“That’s coming along very well. We’re way ahead of schedule,” the president said. “We’re going to be announcing something I would say over the next two or three weeks that will be phenomenal in terms of tax and developing our aviation infrastructure.”

Bond yields would gyrate wildly over the next month, rising to 2.51% in just a week as Treasuries were sold hard on the idea, falling back to 2.31% by February 24, and then another BOND ROUT!!! that took it to 2.62% (the high so far for Reflation #3) by the second week of March. You might develop the sense that bond yields can be quite volatile in the short run, particularly when so-called big things are being absorbed and analyzed as to whether or not they really are big things.

It’s fair to write that the actual passage of the thing is far less of an event in the bond market than that initial introduction. In recent weeks, as the bill’s probability of successful navigation through Congress rose to 100%, yet bond market reaction has been muted apart from the past two days. Even then, it’s not much of a difference so much as another small adjustment in the endless ocean of adjustments that are short-term markets.

Leave A Comment