(Photo Credit: Don McCullough)

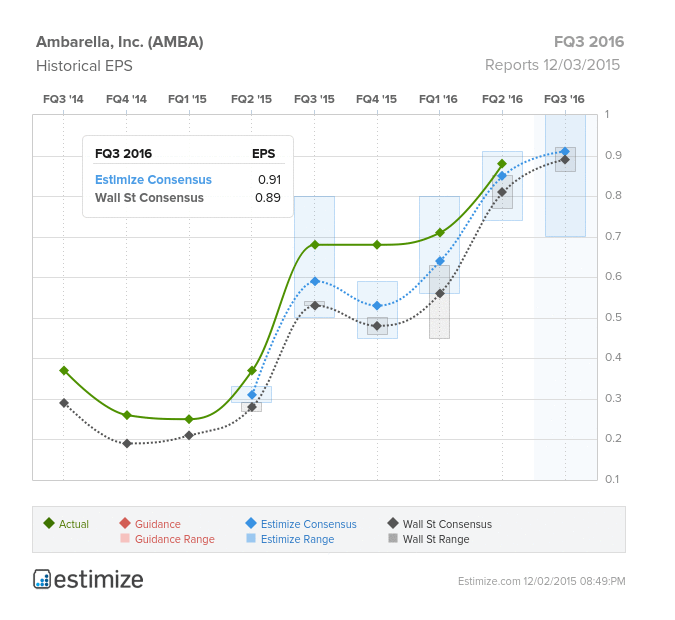

Ambarella, best known for making the chips that go into GoPro cameras, reports their FQ3 2016 results after tomorrow’s closing bell. Currently the Estimize community is looking for EPS of $0.91, two cents higher than the Wall Street consensus. Revenue expectations are also slightly higher at $92.32M vs. the Street’s $91.5M.

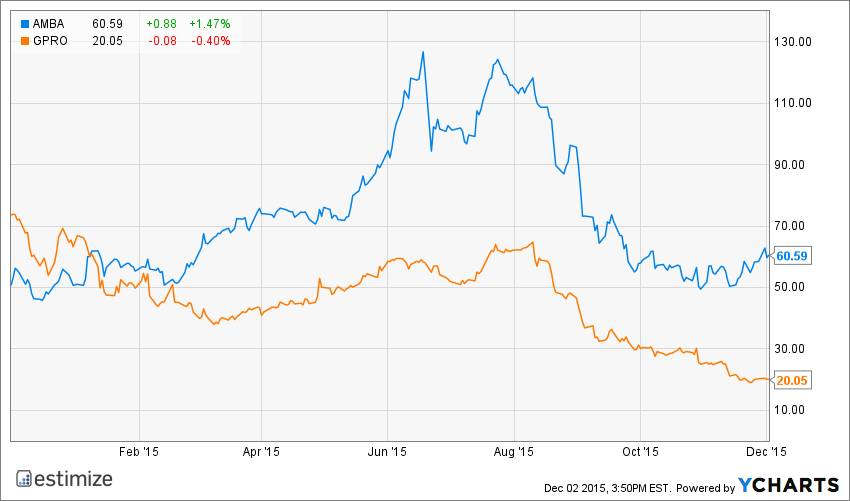

GoPro is Ambarella’s largest customer, and while they have been able to achieve triple-digit quarterly EPS growth since IPOing in June 2014, the company missed the mark big-time in their latest report. In FQ3 2015, GoPro results missed the Estimize consensus by 7 cents on the bottom-line, and by $43M on the top-line. As a result, shares of AMBA fell to $49.44 in the following days, their lowest level of the year. This just continued a downward trend for the stock, which has lost over half of its value since peaking at $126.70 in June.

However, Ambarella has been expanding into several other high-growth markets in order to diversify, including IP Security, Autos, Drones and Wearables. The drone market in particular has been rapidly expanding, with GoPro itself set to launch its quadcopter drone sometime in 2016. Amazon has also been keen to use drones in the product delivery process, pending approval from the FAA. Over the summer, Ambarella acquired VisLab S.r.l., a European company that is a pioneer in perception systems and computer vision, to help develop their security and automotive businesses. The acquisition is anticipated to help ward off competition from the likes of Mobileye and others.

Currently, Ambarella’s stock is up 19% for the year. Investors will be looking for full-year guidance tomorrow, as well as updates on the development of the newer business lines and the product pipeline

AMBA data by YCharts

Leave A Comment