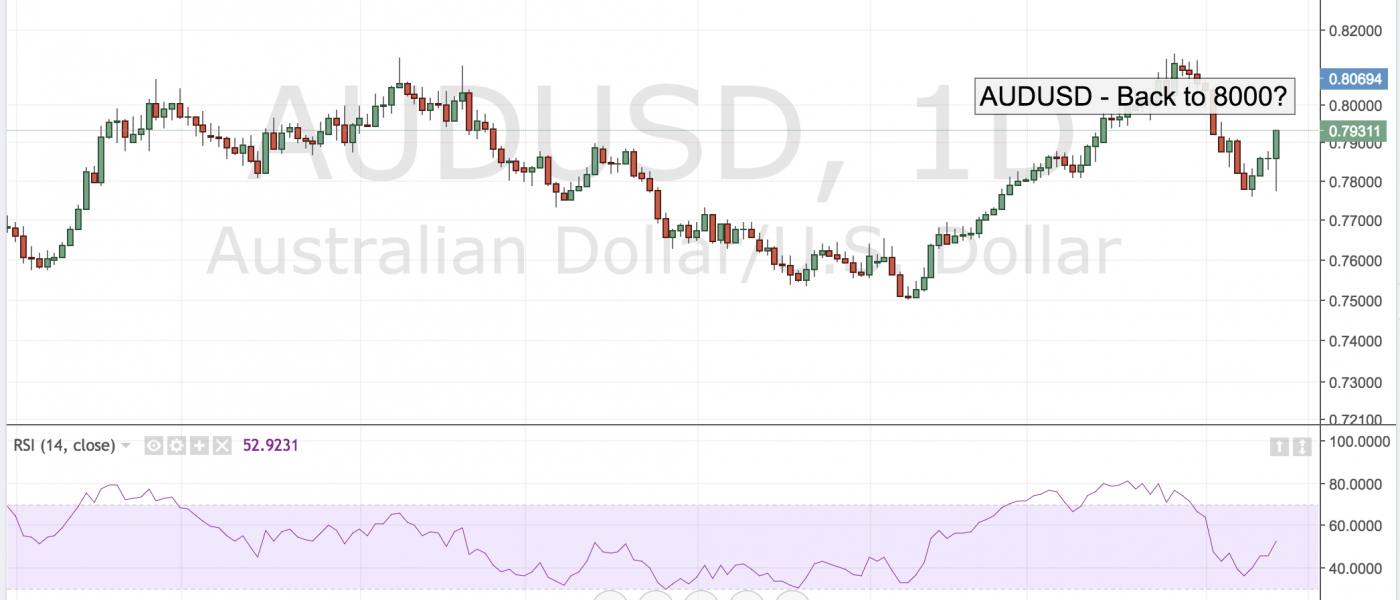

What a monster turn of trade in AUD/USD today as the dollar sell-off created a massive doji in the pair suggesting that more upside is due. The Aussie initially dove lower on assumption that US rates will almost certainly catch up with Australian rates in the wake of higher than expected inflation. But the anti-dollar flows soon flooded back into the pair and it closing at the highs of the day pointing to a possible run towards .8000.

Today AU Employment data could provide the catalyst that the pair needs to move higher if the data surprises to the upside. Although the market expects no action from RBA, if AU labor market shows further signs of tightening, AU policymakers will have to take the threat of inflation seriously and may change their neutral stance faster than the market believes.

For now, the support in the pair remains at .7850 while .8000 represent serious upside resistance on any upside surprise.

Leave A Comment