Those who have followed our blog for some time now know that we are big proponents of technical analysis in reading the trends of the market. This type of examination can also be applied when we are analyzing individual sectors or industries that have diverged from the conventional path of the market.

Last year’s big diverging theme was energy stocks as noted by the -21.50% decline in the Energy Select Sector SPDR (XLE) versus relatively flat performance in the broad-based SPDR S&P 500 ETF (SPY).

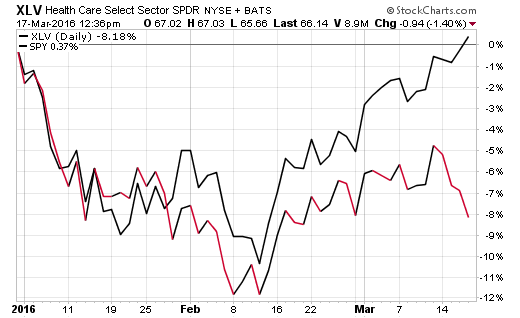

This year, the weakest sector has been health care stocks. The Health Care Select Sector SPDR (XLV) is still down over 8% as SPY begins to peak its head above the flat line.

The biggest contributor to this decline in health care has been the biotechnology industry. The iShares NASDAQ Biotechnology ETF (IBB) has over $5.7 billion dedicated to a market-cap weighted index of 190 biotech companies. Top holdings include large-cap stocks: Celgene Corp (CELG), Amgen Inc (AMGN), and Biogen Inc (BIIB).

There are a plethora of biotech ETFs available in varying styles, weights, and construction methodologies. However, IBB is the largest and most watched index of them all because of its tenure and skew towards the largest companies in this group.

The chart below shows that this ETF recently touched a critical level near $240 and has started to bounce intra-day. This same level was probed in early February and proved to be a key support line.

It goes without saying that if IBB can mount another rally from these levels, it may be viewed by technicians as a bullish “double bottom” price pattern. I point this out for traders and those with a disciplined investment approach because a breach of those lows could also lead to another wave of selling pressure.

If your style involves watching for turnaround potential using price charts and momentum divergences, then this opportunity should certainly be on your radar. IBB is down -27% on a year-to-date basis and has shown in the past that rallies can materialize quickly.

Leave A Comment