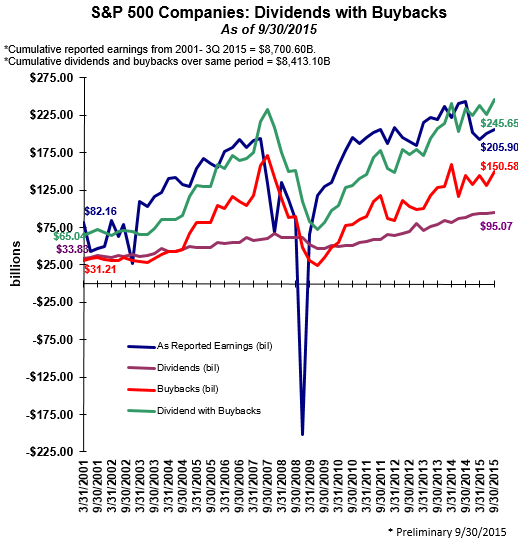

For the third quarter, S&P Dow Jones Indices is reporting that on a quarter over quarter basis buybacks for S&P 500 companies increased 14.5% and increased 3.7% on a year over year basis. The dividend plus buyback yield for the index is 5.53% and is at the highest level since the fourth quarter of 2011. The third quarter total of buybacks and dividends of $245.65 billion exceeded reported earnings of $205.90 billion. This is the fourth consecutive quarter that buybacks and dividends exceeded reported earnings. Highlights from S&P’s buyback releases:

From The Blog of HORAN Capital Advisors

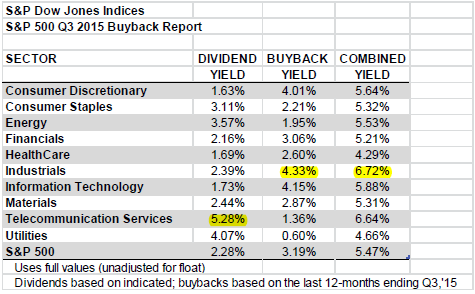

As detailed in the below table, the industrials sector has the highest combined dividend plus buyback yield of all the S&P 500 Index sectors at 6.72%.

From The Blog of HORAN Capital Advisors

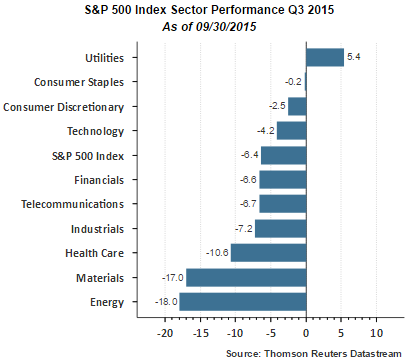

It seems apparent that companies took advantage of the third quarter market weakness in the third quarter to reduce their share count. Historically, this has not always been the case as I noted in an article a few years ago; however, Q3 seems to be the exception.

From The Blog of HORAN Capital Advisors

One key to continued strength in buybacks and dividend growth will be the ability of companies to grow earnings and cash flow. Silverblatt noted in the report,

Leave A Comment