While oil remains oddly muted amid yet another middle-eastern shock, the same can not be said for various precious metals and commodities which are soaring to start the week, and which according to Bloomberg’s Jake Lloyd-Smith, will make for a lively session in Europe and the US, with flow-through gains on the cards for mining-industry stocks that have already been put on edge as BHP Group bids to swallow (most of) Anglo American.  depositphotosCopper and gold – the leading lights of the base and precious metals arenas – are in what Lloyd-Smith puts as “history making mode”, as both powered to record highs in early Monday trading. Here’s a handful of things to watch in what could be a compelling week.

depositphotosCopper and gold – the leading lights of the base and precious metals arenas – are in what Lloyd-Smith puts as “history making mode”, as both powered to record highs in early Monday trading. Here’s a handful of things to watch in what could be a compelling week.

Copper: Everybody’s favorite base metal is benefiting from the fallout from a dramatic short squeeze on the Comex that plays straight into long-standing hype about global deficits to come given the energy transition. Still, some physical indicators remain weak, so watch to see if copper’s prompt spread — which has been mired in an ugly, bearish contango — narrows more this week.

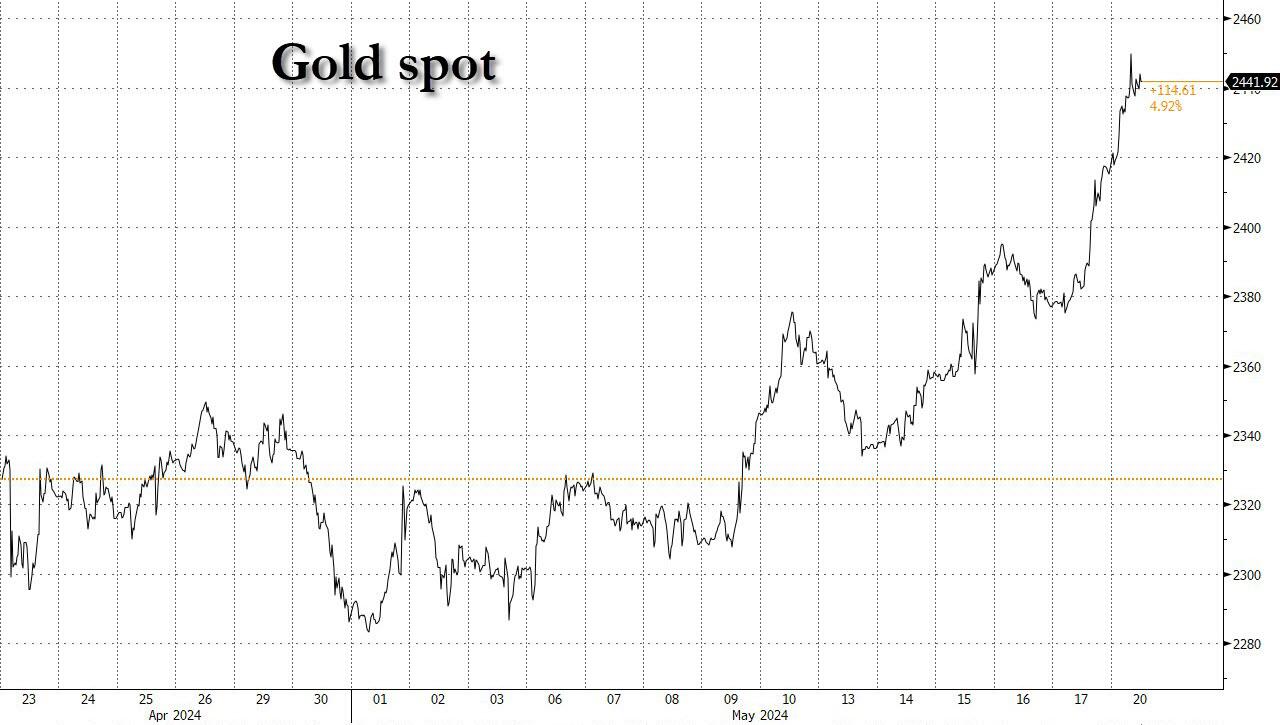

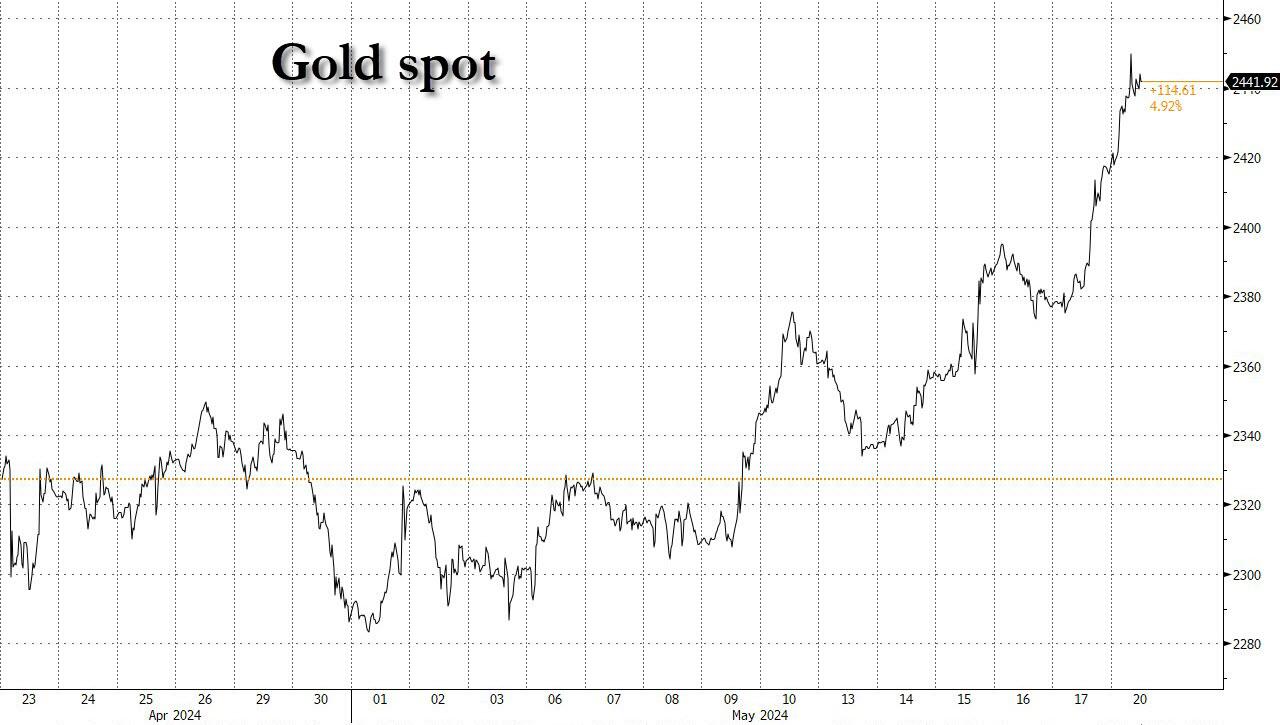

Gold: The Godfather of metals is up +18% YTD and is positioned to challenge $2,500/oz. Its latest leg higher appears to stem from a return to usual drivers: real 10-year Treasury yields are coming off a three-week drop, the longest run in a year. A decent batch of Fedspeak, as well as FOMC minutes will help to set the tone

Silver: is flexing its muscles with gold, up 12% last week and roaring higher again on Monday. Watch to see if the ratio to gold realigns with the long-standing average. That gauge is now back to ~75 , closer to the ~68 since the start of this millennium

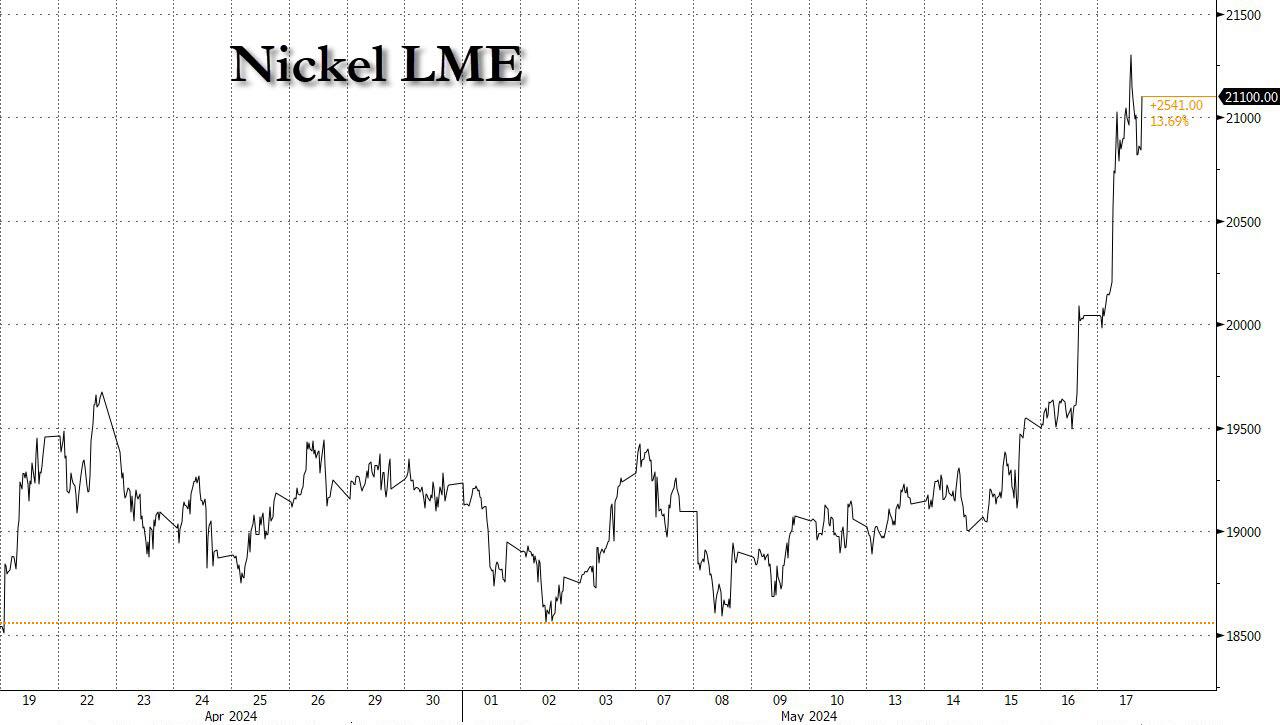

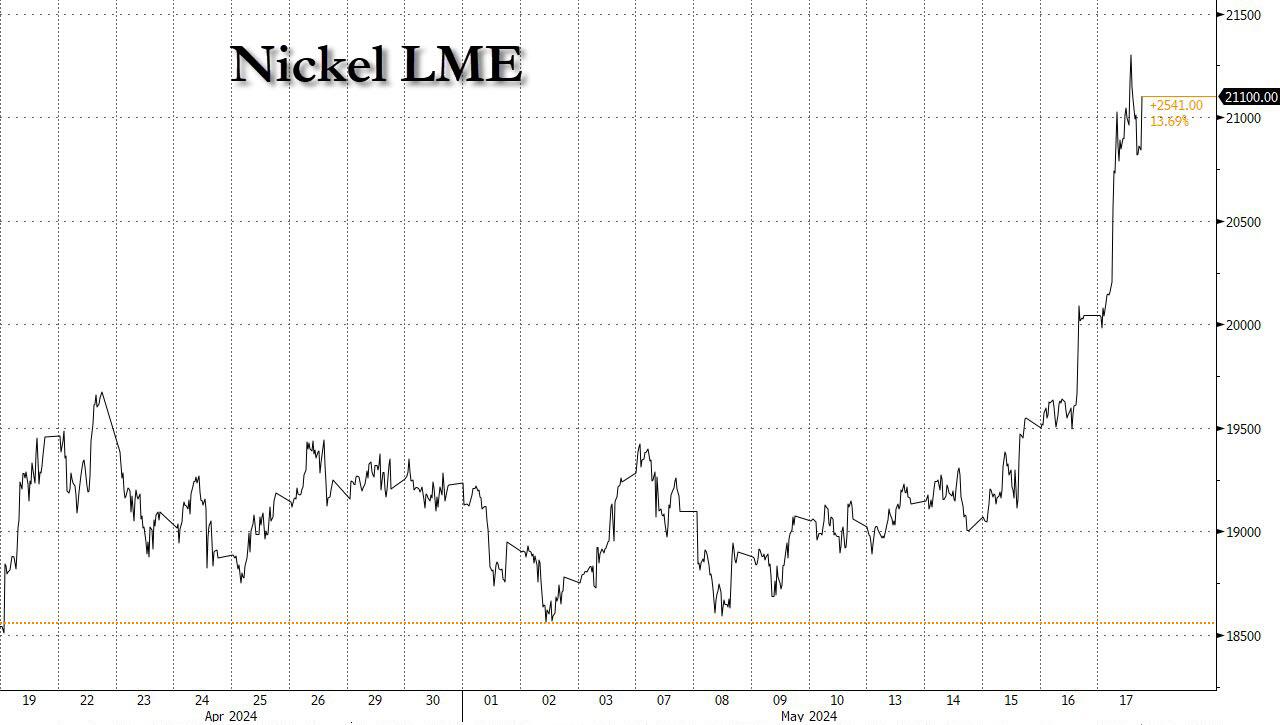

And finally for good measure, here is nickel too, which while not at an all time high yet, may get there soon.

More By This Author:U.S. Banks Suffer $80BN Deposit Decline, Money Market Fund AUM Rise As Stocks SoarStocks Pause After Dow Briefly Touches Historic 40,000US Housing Starts/Permits Ugly In April After Huge Revisions

More By This Author:U.S. Banks Suffer $80BN Deposit Decline, Money Market Fund AUM Rise As Stocks SoarStocks Pause After Dow Briefly Touches Historic 40,000US Housing Starts/Permits Ugly In April After Huge Revisions

depositphotosCopper and gold – the leading lights of the base and precious metals arenas – are in what Lloyd-Smith puts as “history making mode”, as both powered to record highs in early Monday trading. Here’s a handful of things to watch in what could be a compelling week.

depositphotosCopper and gold – the leading lights of the base and precious metals arenas – are in what Lloyd-Smith puts as “history making mode”, as both powered to record highs in early Monday trading. Here’s a handful of things to watch in what could be a compelling week.

More By This Author:U.S. Banks Suffer $80BN Deposit Decline, Money Market Fund AUM Rise As Stocks SoarStocks Pause After Dow Briefly Touches Historic 40,000US Housing Starts/Permits Ugly In April After Huge Revisions

More By This Author:U.S. Banks Suffer $80BN Deposit Decline, Money Market Fund AUM Rise As Stocks SoarStocks Pause After Dow Briefly Touches Historic 40,000US Housing Starts/Permits Ugly In April After Huge Revisions

Leave A Comment