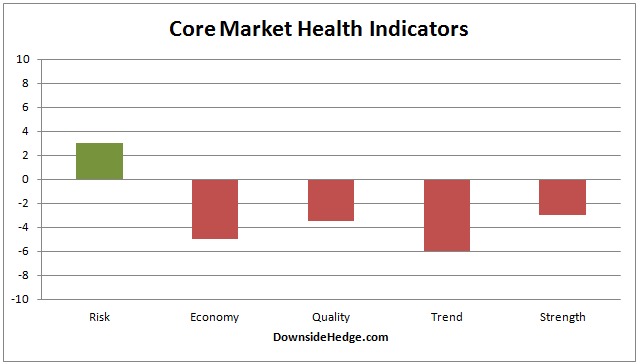

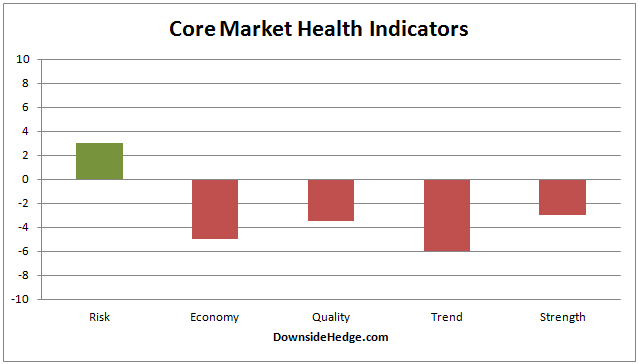

Over the past week most of my core measures of market health improved. Most notably is that my measures of risk went positive.

This changes the portfolio allocations as follows:

Long / Cash portfolio: 20% long and 80% cash

Long / Short Hedged portfolio: 60% long high beta stocks and 40% short the S&P 500 Index (or the ETF SH)

Volatility Hedged portfolio: 100% long (from 10/9/15)

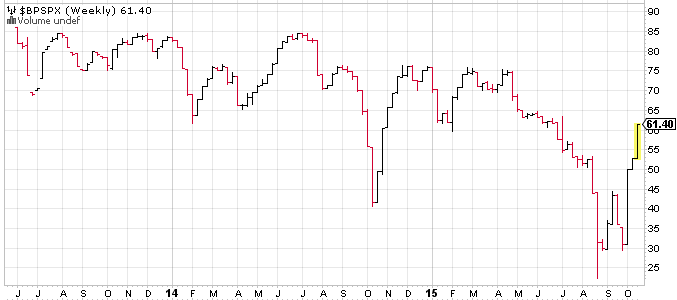

Another thing of note this week is that the Bullish Percent Index (BPSPX) is back above 60%. This reduces the risk of a steep or waterfall type decline. Here’s a post that explains the risk associated with poor breadth in the market.

Leave A Comment