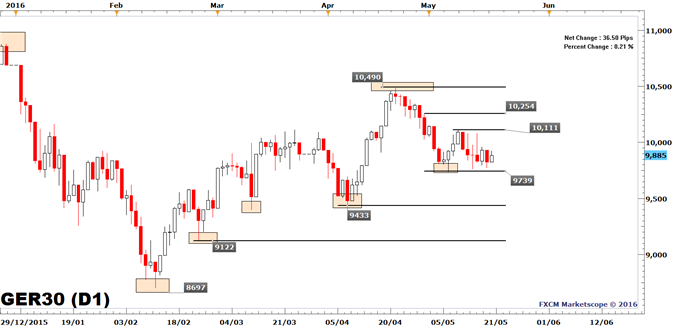

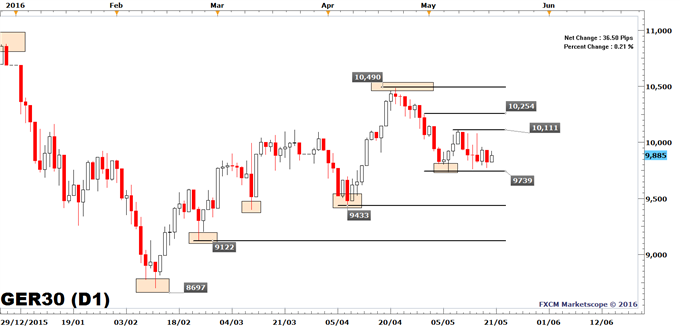

The DAX 30 (CFD: GER30) was up by 0.60% at the time of writing, gains which were led by the Material and Industrial Sectors. While the DAX 30 was up on the day, price was still confined to the 9739-10,111 range; these levels are the May 6 low and the May 10 high respectively. Within this range, there is no clear price trend and the DAX 30 may therefore continue to tread water.

Beyond the near term, price action in the longer run (February 11 to be exact), may induce a bullish trend as price has been creating higher lows and highs since then.

The last swing low of this bullish trend is the May 6 low of 9739 and as price is bullish above this level, price may continue to drift higher over the next few weeks according to the rules of classic technical analysis.

A break to the May 6 low of 9739 would end the sequence of higher lows and could mean the end of the bullish trend.

The next major support level below the May 6 level is the April 7 low of 9433. A short-term support level between these major figures of 9433 and 9739 is the April 12 low of 9619, followed by the April 11 low of 9524. Relevant resistance levels are the May 10 high of 10,111, accompanied by the April 29 high of 10,254 and the April monthly high of 10,490.

DAX 30 | CFD: GER30

Earlier today, a report showed that German Producer Prices declined by -3.1% YoY which matches the March outcome, but is lower than the -3.1% expected per a Bloomberg News survey. Producer prices have been in deflation since 2013 and there overall trend remains negative e.g. the deflation in German Producer Prices is increasing. Low Producer Prices means that producers have little incentive to rise prices to consumers, which may keep German Consumer Prices soft too. This may ensure the ECB easy monetary policy remains in place for longer, which is good for DAX 30 firms, as their financing costs will remain low.

Leave A Comment