“No matter how you “slice-and-dice the data,” hedge funds are struggling to meet their promise to clients to consistently produce high returns with low correlation to markets. It’s kind of: ‘I promise you a Rolls Royce and I give you a Honda.’” – Matt Granade, Chief Market Intelligence Officer, Point72 Asset Management

There are more hedge funds in the world than Dunkin’ Donuts. What does that statement have to do with negative alpha? Everything.

Too many funds + similar strategies + limited opportunity set + high fees = underwhelming returns. Simply put: there’s not enough alpha to go around.

Back in the day, long/short equity funds (the largest hedge fund strategy by assets) actually used to hedge. They used to take risk. They used to look quite different than the overall stock market. And they used to deliver alpha.

How do they look today?

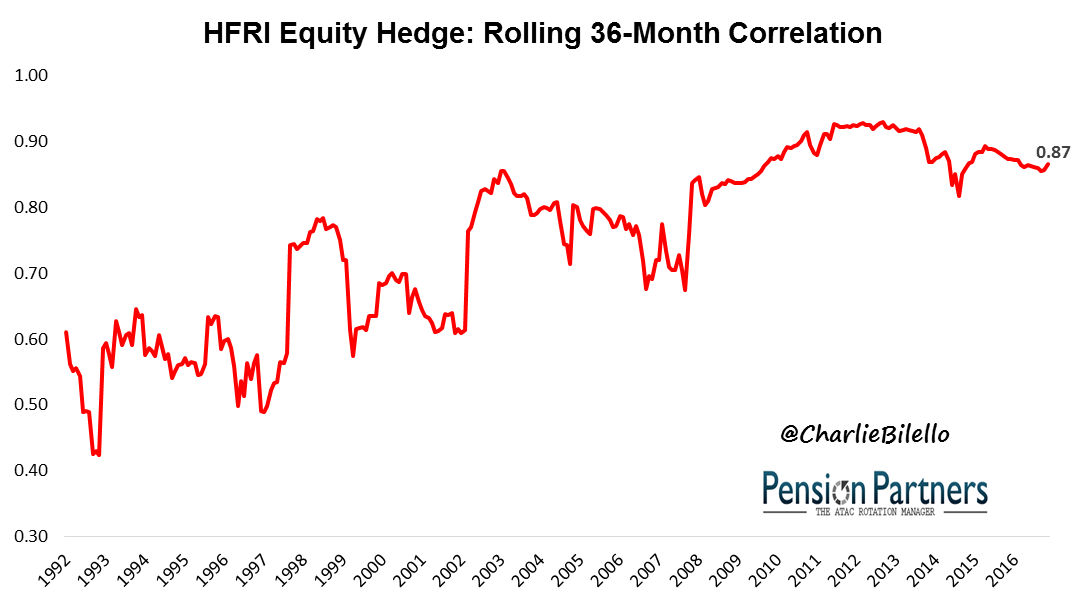

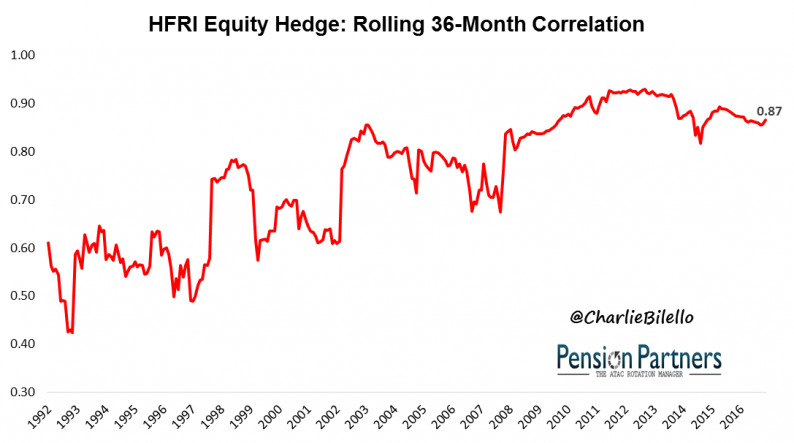

In aggregate, like a lower beta version of an index fund. With a correlation of 0.87 to the S&P 500 over the past few years, they pretty much move in lockstep with the market.

Note: the HFRI Equity Hedge Index is comprised of investment managers who maintain positions, both long and short, in primarily equity and equity derivative securities.

With such a high correlation, those using long/short funds to “protect” against the next bear market are likely to be highly disappointed when it comes.

How do we know this? We have a number of data points in recent years.

In 2008, when the S&P 500 lost 37%, long/short funds were down 26.7%. In 2011, when the S&P 500 dropped 16.3% from May through September (monthly closing basis), long/short equity funds lost 13.2%.

Since March 2009, the S&P 500 has had 29 down months with an average return during those months of -2.9%. Long/Short funds were down in 28 out of 29 of those months with an average return of -1.8%.

As long as their net exposure to the broad market remains high (not a lot of hedging), investors should expect the next downturn in equities to lead to a similar result.

Leave A Comment