Big bank earnings were a big disappointment. But, there’s still plenty of growth and income opportunities in the industry, that is, if you know where to look. These are the top five regional banks that will outpace the industry heavyweights.

We just made it through big bank earnings, and that was bad news for many bank investors.

The top two big banks, JPMorgan (NYSE: JPM) and Wells Fargo (NYSE: WFC), saw their shares tumble after reporting earnings.

This comes as the big banks are still having trouble making money in this low-interest rate environment. With that, none of the big banks jumped out as a screaming buy after earnings.

There are steady dividend yields and growth to be found in banks, just not big banks. So, instead of buying the megabanks, which still can’t seem to figure out how to make consistent money in this post financial crisis era, it might be time to pick up some regional bank exposure.

Many regional banks don’t have as much exposure to low-interest rates and have sounder balance sheets. Balance sheets that should see further loan growth to drive earnings, while big banks are left dealing with rising legal costs and declining mortgage-related revenues.

With all that in mind, here are the top five regional banks:

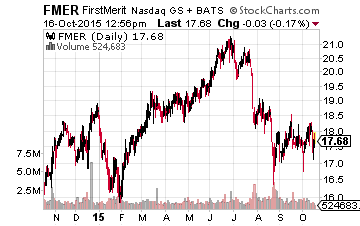

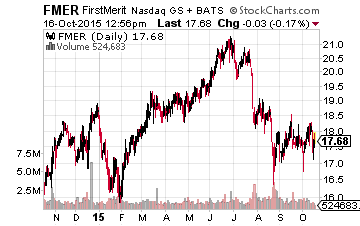

Regional stock to own no. 1: FirstMerit Corp (NASDAQ: FMER)

FirstMerit is perhaps the most interesting regional bank around. Shares trade right at book value, which is in line with the likes of JPMorgan, but its dividend yield is an impressive 3.8%. The yield FirstMerit is offering is more than double the yield on the Select Sector Financial SPDR (NYSEArca: XLF).

FirstMerit is flying under the radar, spending the last five years growing via acquisitions. With that, it’s more than doubled its asset base. Its core markets are in the Midwest, with a focus on Chicago.

Charge-offs remain low at FirstMerit and its funding costs are impressively low, at 0.2% as of last year. The 80% loan-to-deposit ratio means that there’s room to boost its high-yield loan portfolio. As rates rise, it is set up nicely for higher returns.

Leave A Comment