Double-digit dividend yields are enticing, but can often be a trap.

A sky-high dividend yield can be like a mirage. It looks great from a distance, but can disappear once reality sets in.

This seems to be the case with Frontier Communications (FTR).

Frontier currently has a 20% dividend yield.

Even in the telecommunications sector, which is typically a high-yielding industry as it is, Frontier blows its peer group out of the water.

Consider that AT&T (T) has a 4.7% dividend yield, which looks relatively puny by comparison.

AT&T is a Dividend Aristocrat, a group of companies in the S&P 500 that have raised dividends for 25+ years.

The trade-off is that AT&T’s lower dividend yield is far more secure than Frontier’s.

A dividend stock is only as good as the sustainability of its payout, which is why investors should resist the urge to buy Frontier, and stick with AT&T instead.

Business Overview

Frontier is in a very difficult position. Conditions are deteriorating in its core operations, and Frontier has lost money in each of the past two years.

The company has responded by acquiring new customers.

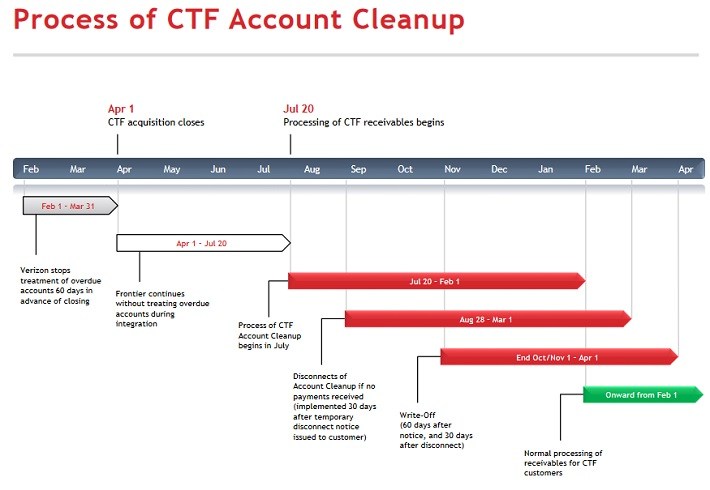

For example, last year Frontier closed on its $10.5 billion acquisition of 6.6 million new connections from Verizon Communications (VZ) half of which were voice customers, in California, Texas, and Florida (CTF).

The problem with the deal, was that Frontier paid huge amounts of money for wireline assets, which are rapidly becoming obsolete.

Making matters worse, Frontier quickly ran into a problem of unpaid bills.

Source: 4Q Earnings Presentation, page 5

Unpaid bills cost Frontier $45 million of lost revenue in the fourth quarter alone.

Frontier’s average monthly revenue per customer fell to $80.33 last quarter, from $82.34 in the previous quarter.

In 2015 and 2016, the company posted losses of $0.29 per share and $0.51 per share, respectively.

Leave A Comment