I have been following Cameron International (CAM) since Q4 2014 when the divergence in oil prices looked like it was here to stay. However, I got greedy and forgot to take profits on my short play. I am still chafing from losses I incurred after Schlumberger’s (SLB) ill-fated takeover announcement in August. Cameron has since flown under the radar as longs await the deal closing. That said, oil prices are expected to be “lower for longer” and so is Cameron’s business outlook.

The Subsea Segment Is Vulnerable

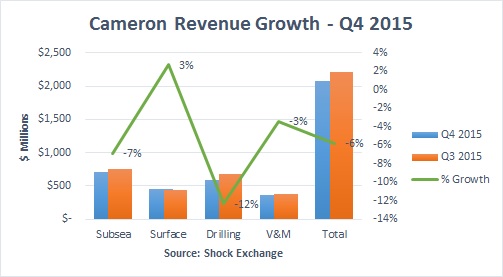

At about 34% of revenue Subsea represents Cameron’s largest segment. Its longer term contracts and stable revenue are expected to complement Schlumberger’s sizable presence with land drillers. Subsea has been a model of stability amid the oil price rout; revenue from the segment experienced sequential growth of 4% in Q2 2015 and 15% in Q3. However, it cracked in Q4, having fallen 7%.

At oil prices sub-$50 many deep water projects are simply uneconomical. New orders have dried up and they may not return any time soon. Other vendors/contractors that play in the offshore market like National Oilwell Varco (NOV), Seadrill (SDRL) and Transocean (RIG) have also seen their contracts dry up or simply cancelled.

In my opinion, Q4 was harbinger of things to come for Cameron’s Subsea segment. Cameron is more diversified than its peers – Dril-Quip (DRQ) and FMC Technologies (FTI) – who garner around 70% of their revenue from subsea. However, the deep water equipment expertise is what Schlumberger is buying and its decline could be disconcerting.

Q1 2016 Could Be Worse

Drilling (28% of revenue) is Cameron’s second largest segment in terms of revenue. It also happens to be its largest contributor to operating income. In Q3 the Drilling segment had a 19% operating income margin (versus 15% for Subsea) and generated 39% of total operating income (versus 30% for Subsea). Drilling revenue is driven by land drilling activity — a segment where clients are cutting capex in order to stem cash burn. It also underperformed the most last quarter with revenue having fallen 12%.

Leave A Comment