Neurotic swings persist without any change in Fed policy (other than wishful thinking from Bulls who wistfully would like to return to a ‘good news is bad news’ reactive market). That crowd, as I’ve noted recently, actually hopes the US economy does not respond to fiscal stimulus of any type; because they need very low interest rates prevailing for their market approach to work. The party ended; and they’ve not sobered up.

One of the problems with that approach, which continues what I warned of as their ‘let’s fight the Fed’ thinking, is that the market has discounted ‘actual’ spirited recovery to the extent that it’s not just about rates (even if mostly so short-term). Now you will need actual growth (beyond those buybacks that have returned to a degree) in profits to justify these high levels the majority of most-concentrated fund holdings are orbiting near (FANG and more of course).

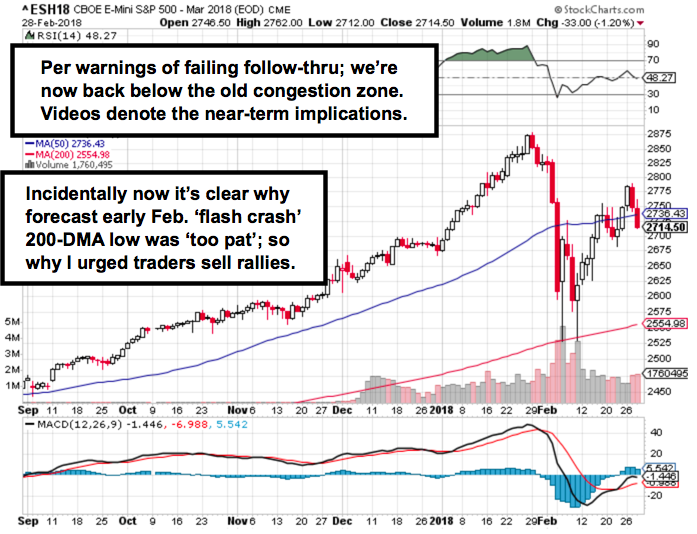

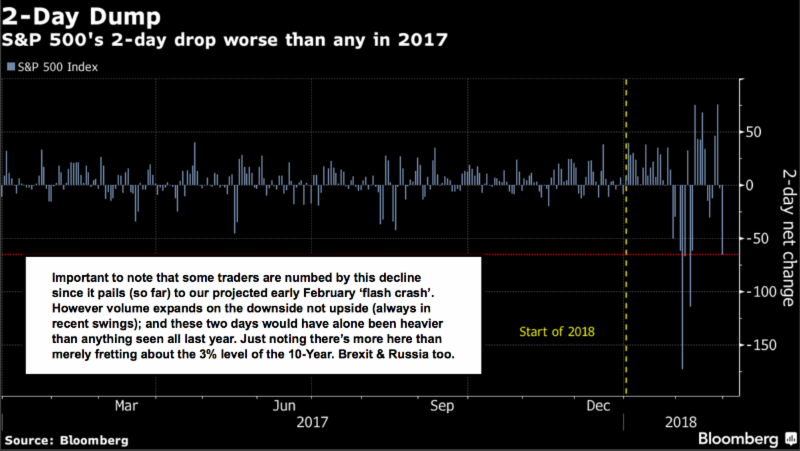

Remember; in January I called the move unsustainable as a parabola; a probably ‘hard break’ by early February; and a rebound that would be for trading not investing. Once we got it and the usual pundits trotted-out a slew of lists to buy (they still do it), it was time to contemplate my overall forecast, which was ‘crack’ the S&P, rebound with Oil and FANG leadership; then as complacency returns prepare for Round 2. Tomorrow we get Round 2 of the Fed Chair; but there’s more afoot. I also saw NO reason for the Chairman to clarify and expected him to be right in line with other Fed heads on policy; as he very likely will be.

Beef Goulash or Shish-Kabob ?

So why are they ‘fighting the Fed’? They are full-boat long. If you had an economic climate that allowed perpetual low interest rates; many money managers envision just continuing to levitate financial assets (like years prior to the Election). The catch is we already had that move; now we need profits beyond those already discounted, to advance prices; not a return to absurdly low interest rates.

Leave A Comment