Uncertainty and mystery are energies of life. Don’t let them scare you unduly, for they keep boredom at bay and spark creativity.

– R. I. Fitzhenry

The average person regardless of their education, or lack of, usually is on the receiving end of the stick when it comes to investing in the markets. The reason for this quandary is really very simple and predicated upon the fact that the average person’s decision-making process is driven by his or her emotional state. Successful investing and emotions do not go together; it’s an awful mix, and the outcome is always the same: stress and loss.

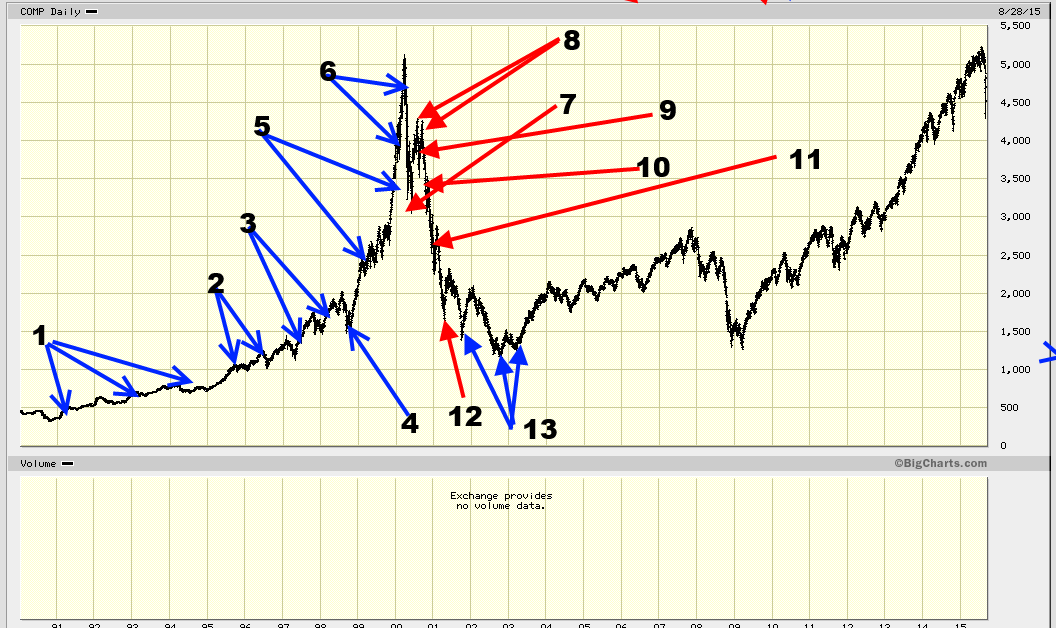

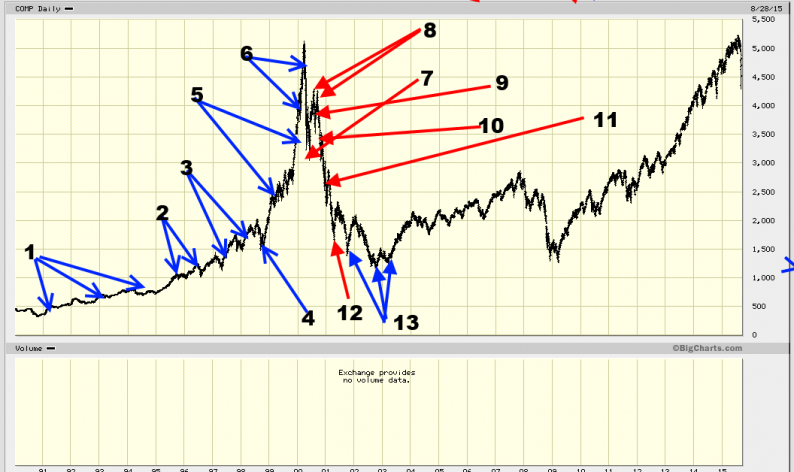

For this example, we are going to use a chart of the Nasdaq to provide an illustration of how emotions drive the average investor when it comes to trading and investing in the stock market. The same principles described below apply to all the other major indices such as the Dow, SPX or major stocks such as GOOG, AAPL, WMT, etc. The diagram below clearly and effectively illustrates the dilemma and uncertainty the average investor inflicts upon themselves. The solution is dangerously simple, but its simplicity is what makes it so hard for the crowd to implement. One needs to throw one’s emotions out of the window when it comes to investing. Emotions should have no seat at the discussion table when it comes to buying or selling a stock. Successful investing entails doing the opposite of what your useless emotions are so dramatically prompting you to do. There is simply no place for any extreme deviation from the norm when it comes to investing and euphoria and panic are extreme deviations from the norm.

Riches come to those who seek it and not chase it. To those who chase it, rags are the only reward. The world can be your oyster, or you can be an oyster in the world.

Click on picture to enlarge

Leave A Comment