Greetings,

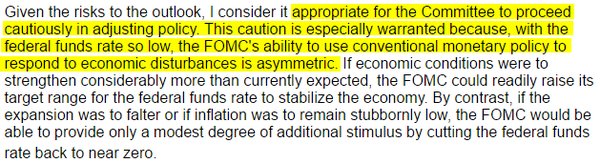

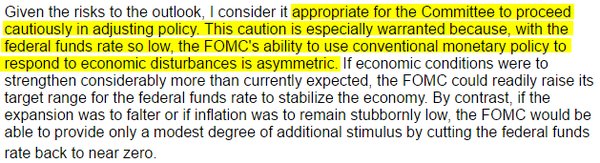

Once again we begin with the United States where the Fed Chair Janet Yellen struck a decisively dovish tone. Here is the key paragraph from her speech on Tuesday.

Source: FRB

She is basically saying that there is no rush to raise rates because the Fed has plenty of room to hike if inflation picks up but little room to cut if things go “pear shaped”. She is clearly not convinced by the FOMC’s own forecasts (especially with respect to inflation) and views significant risks to the downside.

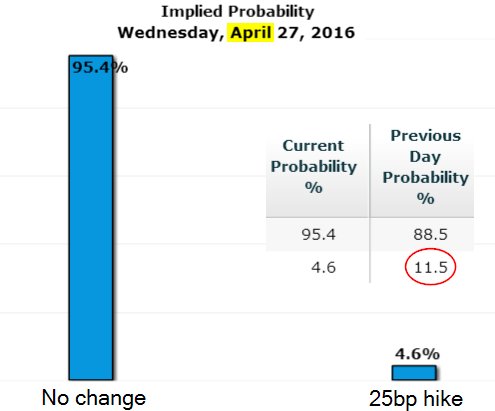

The futures-implied probability of a rate hike in April dropped from 11.5% to 4.6% in response to her statement.

Source: CME

Here are the reactions across several major markets to the speech.

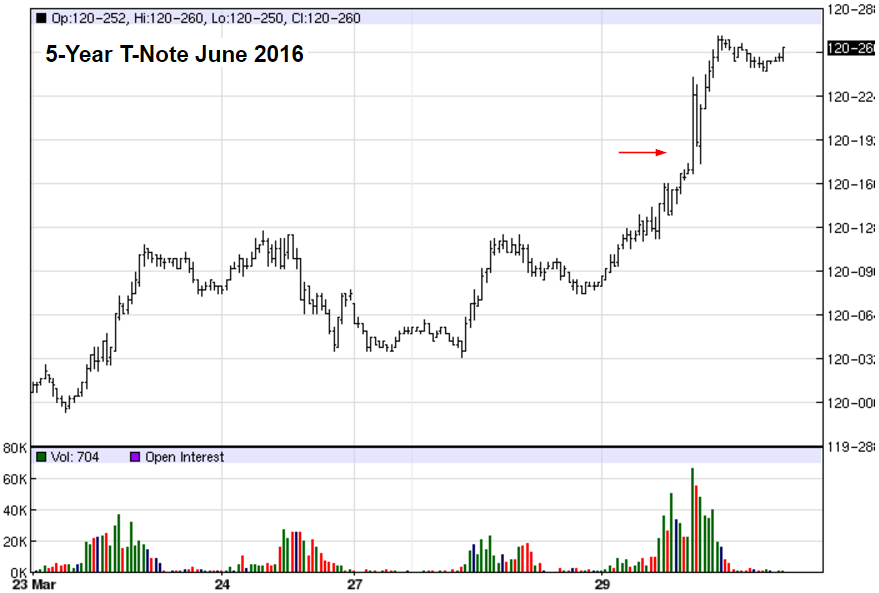

1. The 5-year treasury note futures jumped sharply.

Source: barchart

2. The 2-year treasury yield fell below 0.8% again.

3. Precious metals rallied. Here is gold and platinum.

Source: ?barchart

Source: ?barchart

4. The euro rose above 1.13 again (a frustrating situation for Mario Draghi).

The Kiwi dollar rose 2%.

Source: ?barchart

And the dollar index (DXY) is approaching the 95 level again.

Source: ?barchart

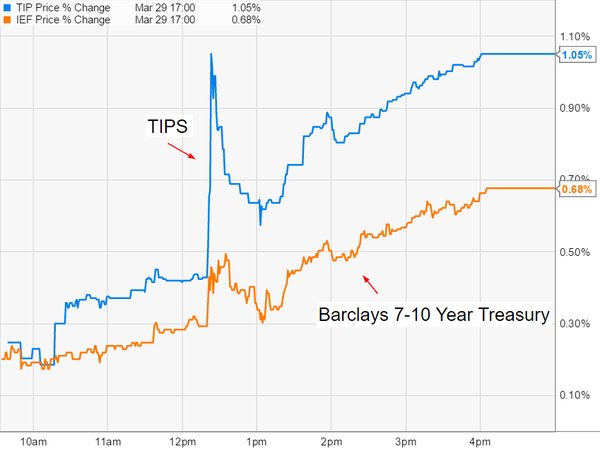

5. Inflation expectations jumped in response to the speech, with TIPS outperforming treasuries.

Source: Ycharts.com

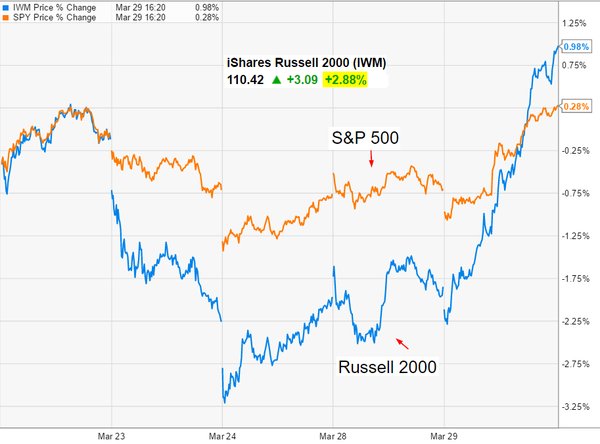

6. In the equity markets, US small caps (Russell 2000) rose almost 3% on the day.

Source: Ycharts.com

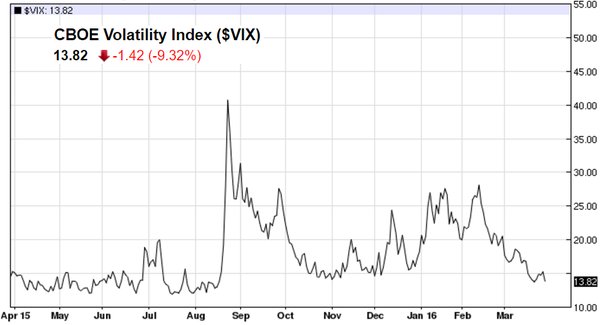

7. With the risk-on sentiment returning, VIX fell back below 14.

Source: barchart

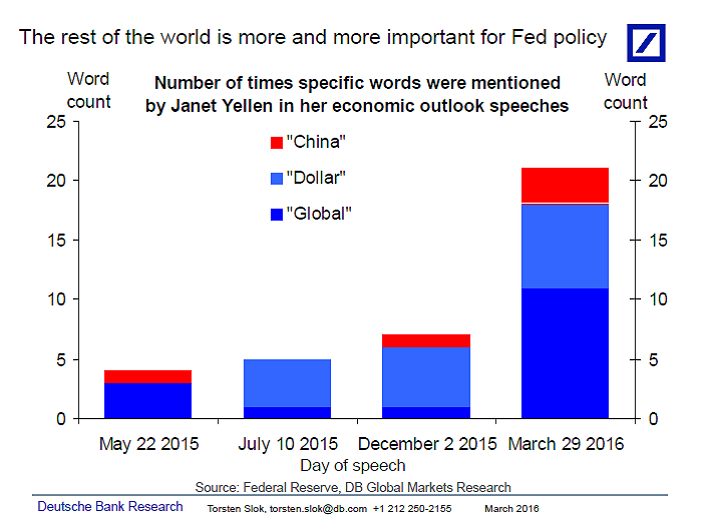

It took the Fed a couple of years to realize that US monetary policy can’t be managed in isolation. Global risks and the dollar are becoming increasingly important. While the Fed doesn’t have a formal target with respect to the strength of the US dollar, informally the dollar has become a third mandate (employment, inflation, and to some extent the dollar exchange rate).

Source: Deutsche Bank, h/t Stan

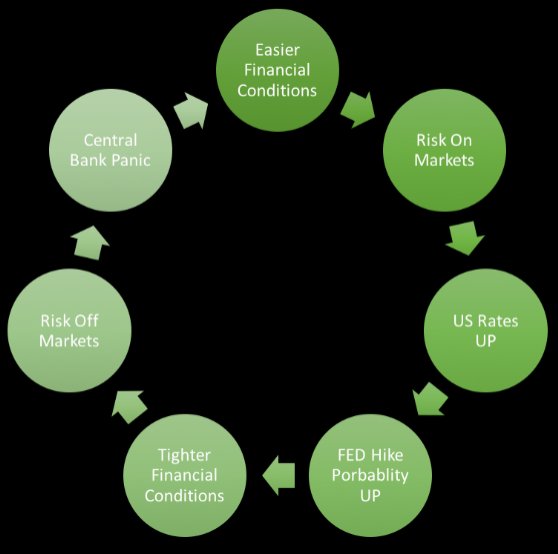

The dilemma, of course, is how one ultimately exits the easy monetary policy.

Source: Alex

In other economic news in the United States, Lennar, a large homebuilder, had a surprisingly strong quarter. Demand for housing remains robust.

Leave A Comment