Central bankers seem to think that adjusting interest rates is a nice little tool that they can easily handle. The problem is that higher interest rates affect the economy in many ways simultaneously. The lessons that seem to have been learned from past rate hikes may not be applicable today.

Furthermore, there can be quite a long time lag involved. Thus, by the time a central banker starts seeing an effect, it may be clear that the amount of the interest rate change is far too large.

A recent ZeroHedge article seems to suggest that problems can arise with 10-year Treasury interest rates of less of than 3%. We may be facing a period of declining acceptable interest rates.

Let’s look at a few of the issues involved:

[1] The standard reason for raising interest rates seems to be concern about inflationary impacts occurring as a result of rising food and energy prices. In practice, the impact of such an interest rate change can be quite severe and quite delayed.

Figure 2 is an illustration from the Bureau of Labor Statistics website showing one of today’s concerns: rising energy costs. Food prices are not yet rising. Normally, however, if oil prices rise, the cost of producing food will also rise. This happens because modern agricultural methods and transportation to markets both require the use of petroleum products.

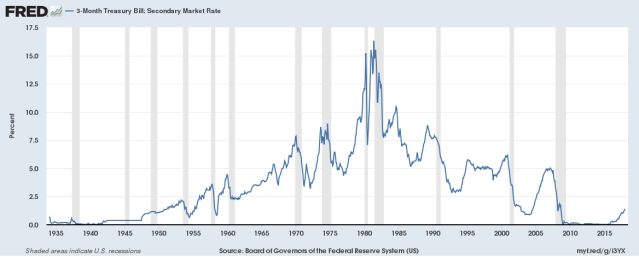

In fact, raising short-term interest rates seems to have been associated with trying to bring down rising food and energy costs, as early as the 1970s and early 1980s.

The reason why an increase in short-term interest rates is helpful is because it reliably induces a recession. A person can see the close connection between short-term interest rate increases and recessions (gray bars) in Figure 3. Recessions in turn damp down food and energy prices.

The reason why this damping down effect occurs is because when there is a recession, many people are laid off from work. These people purchase fewer goods and services. With people out of work, “demand” for goods and services falls. (Demand is very closely related to “amount affordable.”) We might think of demand for goods and services as helping to maintain the “production” of new homes, new cars, upscale food products, toys, and even consulting services.

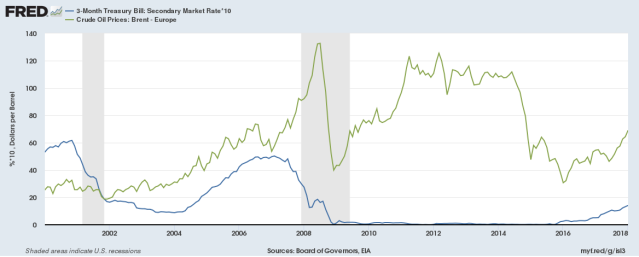

When demand falls, fewer goods of practically every type are made. This indirectly leads to less need for commodities of many types, including oil, natural gas, metals, and food. Commodities have very long production cycles, and only modest storage facilities. When lower demand for a commodity such as oil occurs, prices tend to adjust sharply downward, in order to signal the need for lower production. Figure 4 shows that interest rate spikes corresponded to the 1973-1974 oil price spike, the 1979 oil price spike, the 2004-2008 price run-up, and perhaps to other shorter oil price spikes.

The annual data in Figure 4 loses the detail of month-to-month variations. Because of this, it makes the impact of the Great Recession look much less severe than it really was. Figure 5, using monthly data for recent periods, shows more clearly the severe fall in oil prices following the run-up in short-term interest rates in the 2004-2007 period.

If a person looks at the indirect impacts on the economy as a whole, it becomes clear that the rise in short-term interest rates was one of the proximate causes of the Great Recession of 2008-2009. I talk about this in Oil Supply Limits and the Continuing Financial Crisis. The minutes of the June 2004 Federal Reserve Open Market Committee indicate that the committee decided to start raising interest rates at a rate of 0.25% per quarter for the purpose of stopping the rise in energy and food prices.

The huge financial problems that indirectly resulted did not occur until four years later, in 2008. It is likely that most economists are unaware of the connection between the decision to raise rates back in 2004 and the Great Recession several years later.

[2] Higher energy prices squeeze a person’s “spendable income.” Higher interest rates have the same effect.

Economist James Hamilton showed that ten out of eleven recent recessions were associated with oil price shocks. We would argue that if an economy is subject to higher interest rates in addition to higher oil prices, the economy is doubly likely to go into recession. Figure 6 shows an illustration of the situation.

Leave A Comment