The devaluationary spiral of the peso began with the fall in oil prices in mid-2014. At the time, the depreciation was easy to explain in terms of the deterioration of the balance of trade. With Mexico being a net oil-exporting country, the fall of oil prices meant a fall in the country’s foreign currency revenue. This situation explains the depreciation of the peso of mid-2014 and all of 2015.

In 2016 the situation gets complicated

The victory of the Brexit referendum in June 2016 deteriorated expectations of the Mexican economy’s performance, lowering the price of the peso against the dollar.

Things got worse for the Mexican peso in November 2016, when Donald Trump was elected as President of the United States. At the time, the pessimism that took hold of investors and speculation lead to a depreciated Mexican peso. As we explained in another article, the peso depreciated 14% in only three days after Trump’s victory.

Banxico reacted without success…

With this scenario, the Bank of Mexico (Banxico) begun a series of efforts to try to defend the peso by raising the benchmark interest rate in 2016. The following graph shows the price of the peso against the dollar on the left axis; on the right, it shows the reference interest rate of Banxico. Banxico practically doubled its reference rate between July 2016 and July 2017.

Graph 1:

Source: Banxico

Two factors helping the peso in 2017

In 2017, things seem to be different for the Mexican peso. Between January and July of 2017, the peso appreciated on average 17% against the dollar. What are the reasons for this behavior? There are at least two.

1.The pessimism caused by Trumps victory has considerably decreased

If in November 2016, investors were nervous after Trump’s victory: they anticipated an attack on NAFTA that would harm the Mexican market. On Wednesday, August 16 Canada, the US, and Mexico started renegotiating NAFTA.

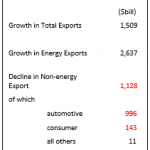

Although there is much expectation for the results, most recognize that Mexico could gain from a NAFTA renegotiation. When the agreement was signed more than 20 years ago, the energy sector was controlled by the government. Since the energy reform by Peña Nieto, there have been proposals to integrate the energy market between the three countries.

Leave A Comment