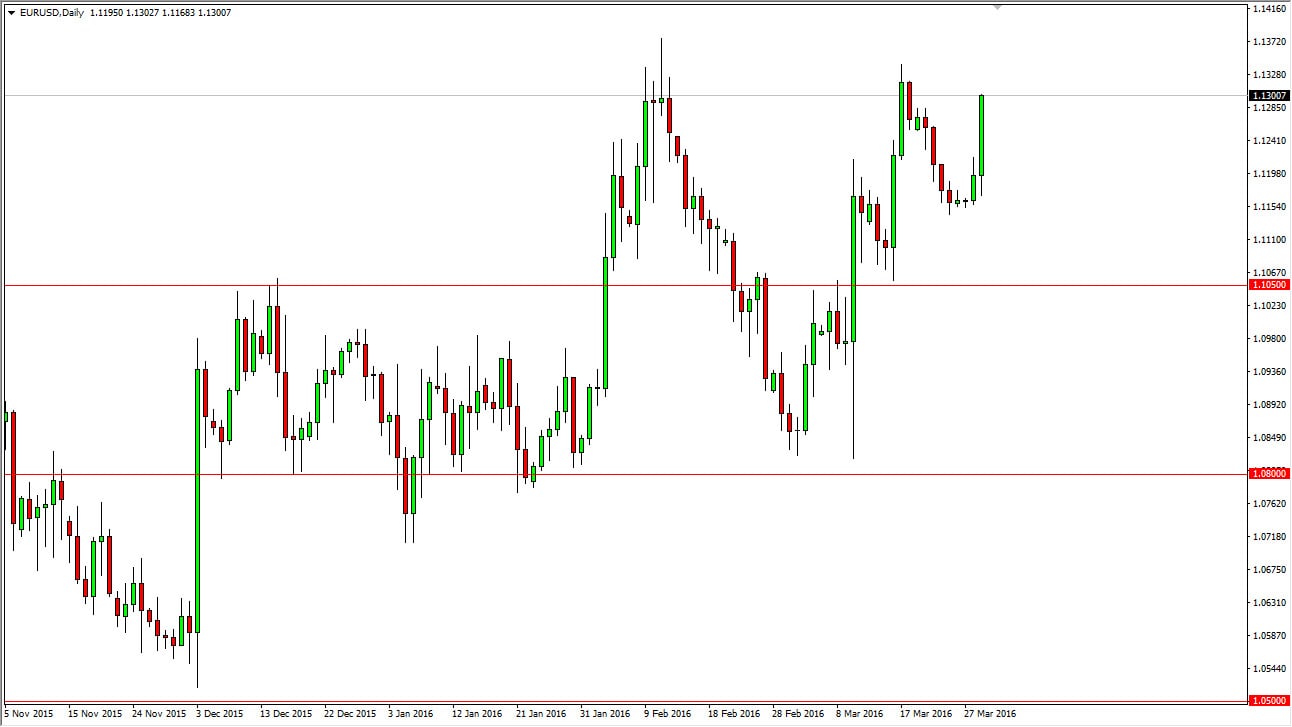

EUR/USD

The EUR/USD pair initially fell during the day on Tuesday, but found enough noise and support below to turn around and shoot much higher. With this, it’s very likely that we will continue to see quite a bit of bullish pressure and now that we are touching the 1.13 level, I now think that we are ready to start making a serious attempt at the 1.15 level again. The Federal Reserve stepping away from at least a couple of interest-rate hikes of course continues to put the USD or on the back foot, but quite frankly I don’t know whether or not we can break above the 1.15 level, because the European Central Bank has hinted that they may have to keep their monetary policy extraordinarily light, and done base to say the least. Nonetheless though, I think of this point in time it’s fairly reasonable to assume that we’re going higher, either on a break above the top of the candle or a pullback to show signs of support.

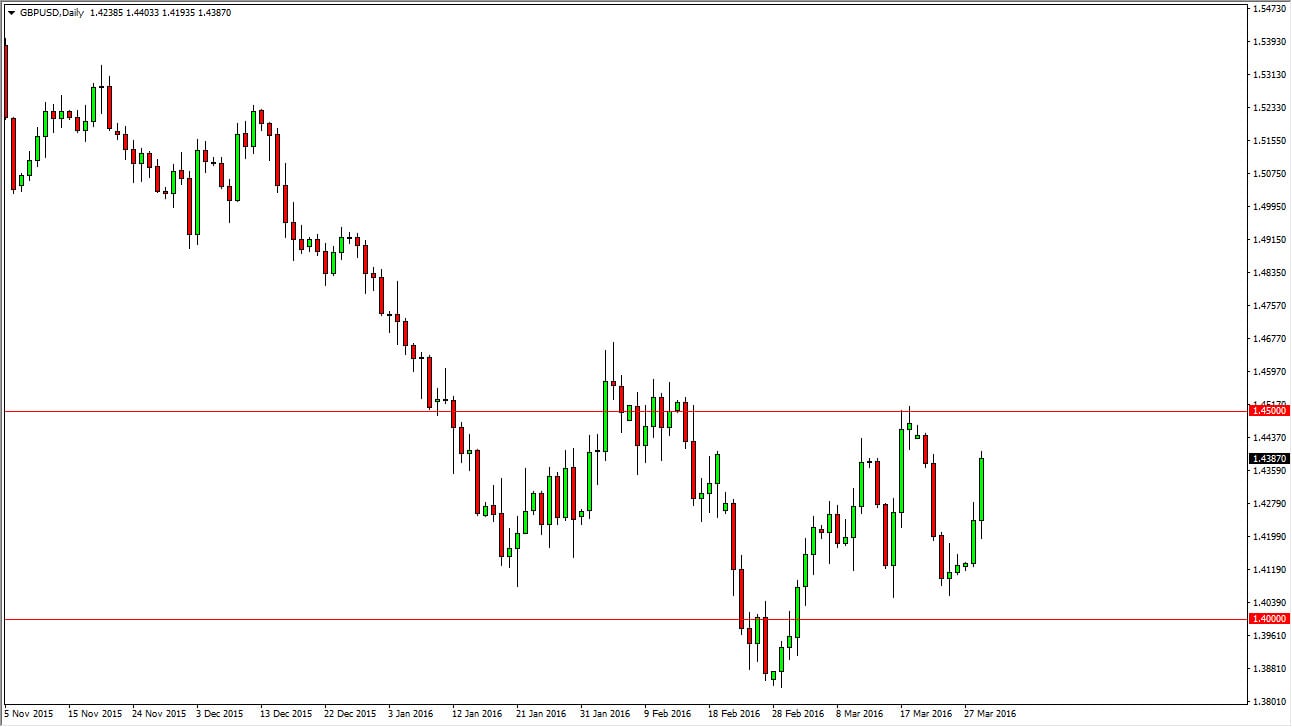

GBP/USD

The GBP/USD pair did very much the same during the course of the day on Tuesday, testing the 1.44 level. I see quite a bit of resistance above the 1.44 level, extending all the way to the 1.45 handle, so I don’t know whether or not we can break out yet. With that, I would be a seller of a resistive candle if we get it on a daily close, as we would then just simply continue to consolidate between the 1.40 level on the bottom, and the 1.45 level on the top. With this, I think that at this point in time if you are not already long of this market, you would simply be chasing the trade. Because of this, I’m going to wait to see whether or not we can break out to the upside, or if we get an exhaustive candle in order to place another trade. Pullbacks could be used as buying opportunities, but we would have to see a nice supportive candle.

Leave A Comment