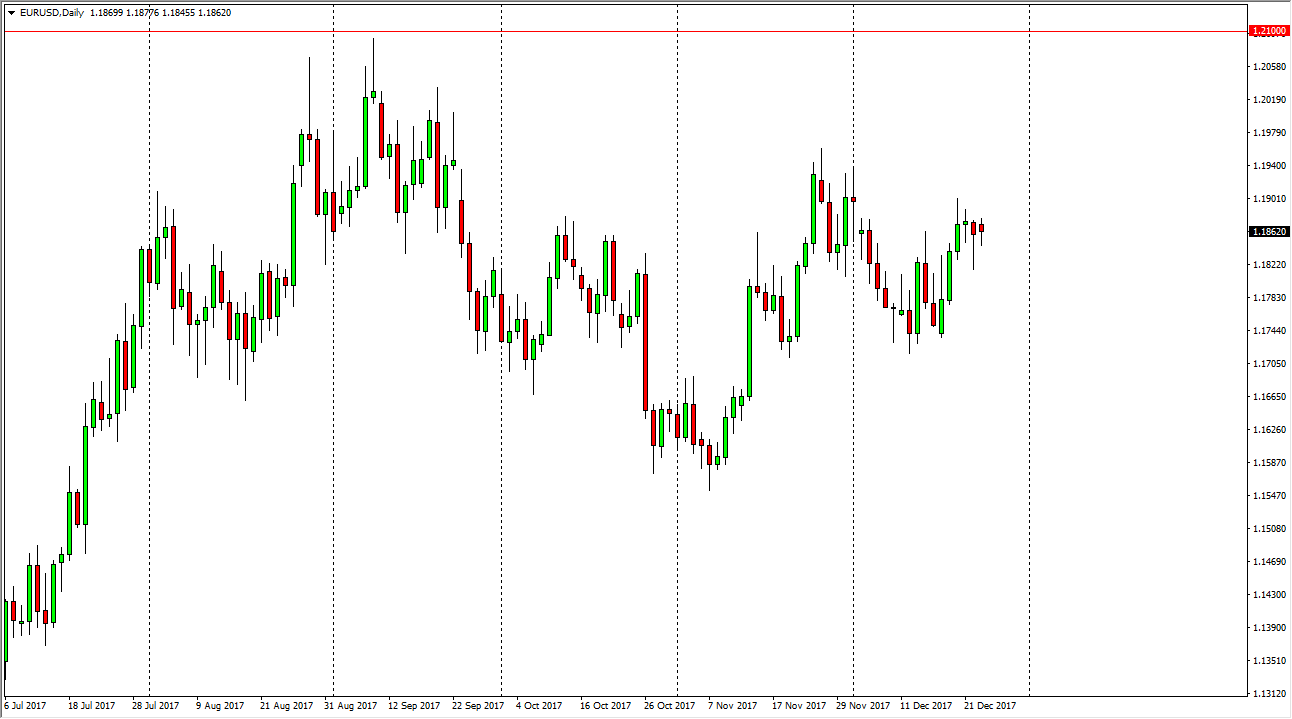

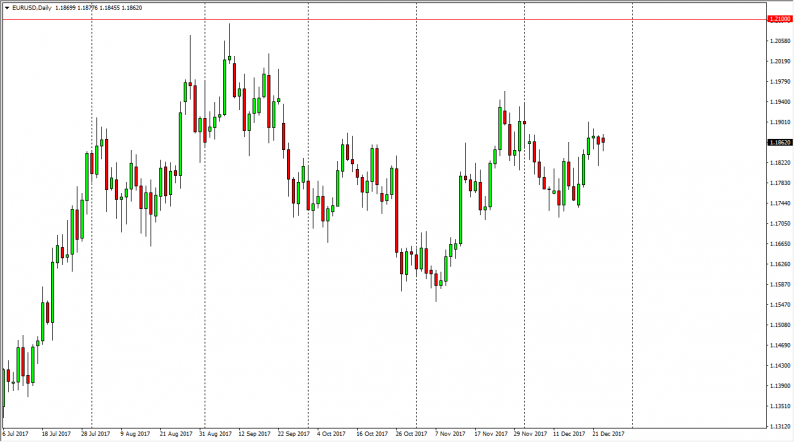

EUR/USD

The EUR/USD pair fell during the trading session on Tuesday, but found enough support near the 1.1850 level to turn things around and form a hammer. The hammer is preceded by a hammer as well, so that’s a good indication that there are plenty of buyers willing to get involved. I think that once we break above the 1.19 handle, it’s likely that we continue to go higher, perhaps to the 1.20 level and then the 1.21 level after that. Longer-term, when you look at the EUR/USD pair, it is forming a massive bullish flag on the weekly chart, so keep that in mind when we go higher. That should give us an opportunity to continue to climb. If we break down below the 1.17 handle, the market probably falls to the 1.15 level.

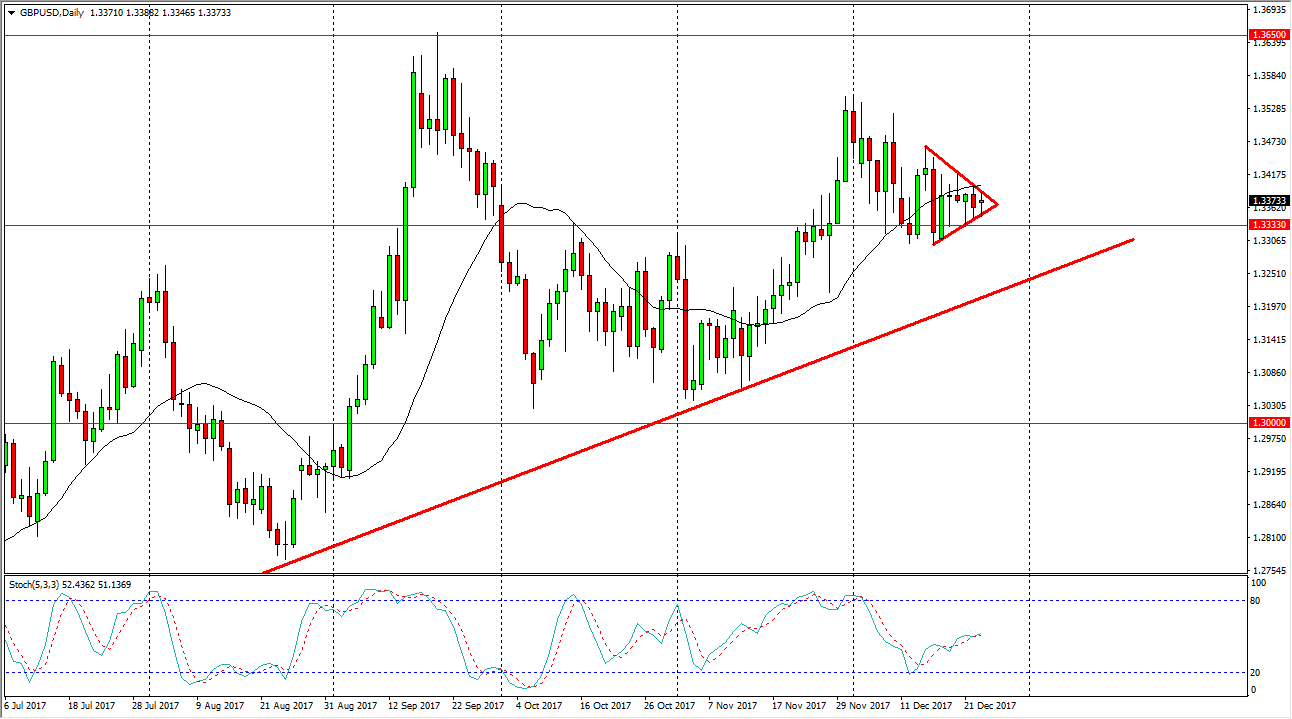

GBP/USD

The British pound went back and forth during the day, forming a neutral candle as there is a lot of indecision. We are currently in a symmetrical triangle, which suggests that we are getting ready to make some type of situation. The uptrend line underneath should continue to offer plenty of support though, especially near the 1.31 handle. I believe that the 1.3333 level should be supportive, so even if we break down below there, I think there’s plenty of reason to think that we will eventually bounce. If we break to the 1.35 handle, that is an area that we can see some resistance at. A break above there should send the market to the 1.3650 level which is the massive gap that sent this market much lower. If we can break above there, then we could continue to go much higher as it is a sign that the trend is changing longer term.

Leave A Comment