EUR/USD had yet another excellent week, rising to higher ground on the US dollar weakness and Draghi’s unsuccessful jawboning. What’s next? The upcoming week features all-important GDP and inflation numbers. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The ECB left the rates unchanged and will take its time with announcing the next steps in its QE program. ECB President Mario Draghi mentioned the exchange rate but his complaints were feeble allowing the euro to rise and shine. He seemed to have more criticism about Mnuchin’s comments than any jawboning of his own. Mnuchin, the US Treasury Secretary, said that “a weak dollar is good for the US“, adding fuel to the US dollar selloff fire. His comments were somewhat taken out of context and his boss, President Trump, later supported a strong dollar. Nevertheless, a variety of reasons sent the dollar lower and the euro certainly took advantage of it and for good reasons. Euro-zone PMIs and two key German surveys showed expectations for strong growth also in 2018.

Updates:

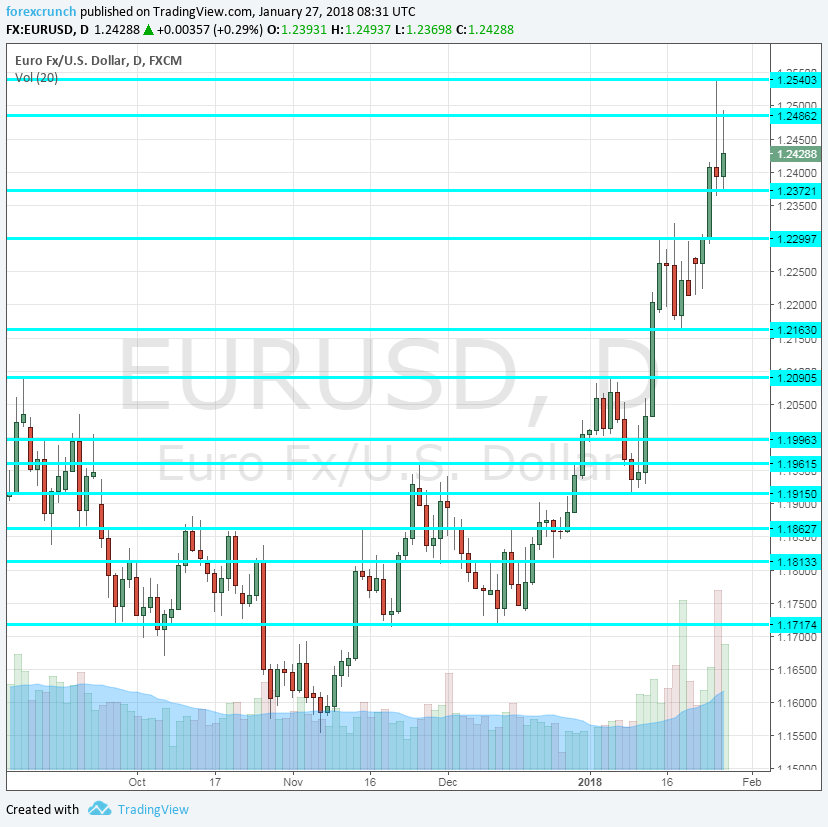

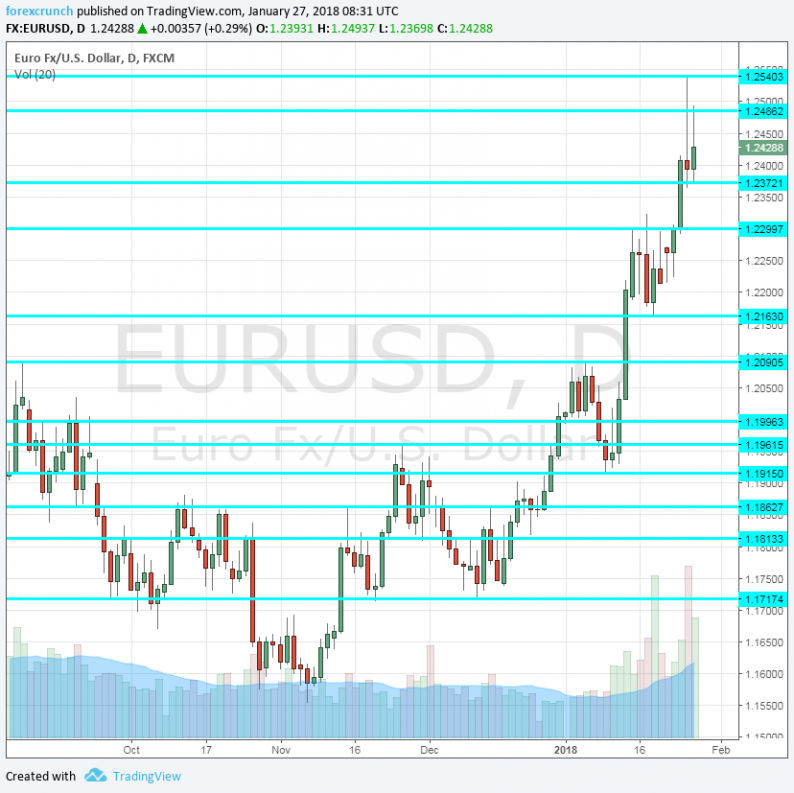

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

Leave A Comment