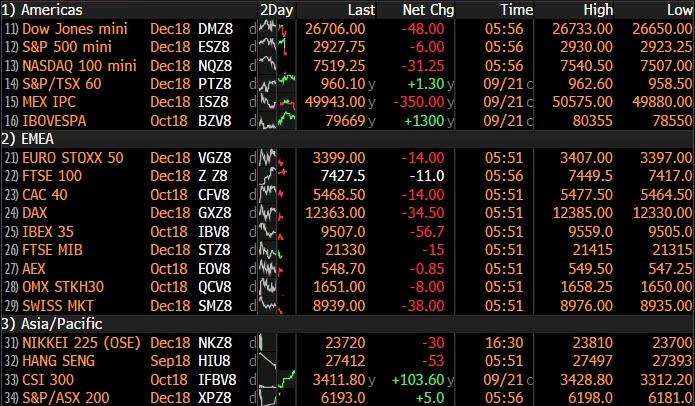

U.S. stock futures followed European and Asian shares lower in thin volume after China called off planned trade talks with the U.S. and the Trump administration imposed another $200 billion in “Phase II” China tariffs just after midnight; oil jumped 2.4% as OPEC+ members defied Trump’s calls for lower oil prices during a weekend conference, refusing to boost output.

Asia set the downbeat tone as Hong Kong stocks fell, while thinner than average volumes across Asia due to holidays in China, South Korea and Japan. “Given that the trade talks are off, investors will be watching what happens after the implementation of the tariffs and particularly whether the U.S. will move to the next phase, which would be tariffs on a further $267 billion of Chinese goods,” said Dushyant Padmanabhan, a currency strategist at Nomura in Singapore. White House trade adviser Peter Navarro said on NPR’s Morning Edition that “the president was crystal clear in his statement: if China retaliates, the process will move forward on the additional amount.”

European stocks followed lower, with miners and carmakers, both sectors heavily exposed to global trade, among the biggest decliners in the Stoxx Europe 600 Index, while futures on the S&P 500 and Dow pointed to a weaker open. Randgold Resources and bucked the trend to rally on merger news following news of a merger with Barrick, creating the world’s largest gold miner; Sky also rose after Comcast beat Fox in the auction for the broadcaster with a $39 billion bid, a deal that has been two years in the making. Comcast will start buying Sky shares in the market in order to reach the 50% threshold before the Oct. 11 deadline. Current shareholders just got an extra 9% for their patience as Comcast will pay 1,728p for the shares. What Fox will do with its 39% stake is still unknown. Elsewhere, Carrefour denied it approached Casino Guichard-Perrachon only hours after the rival grocer said its board rebuffed a proposal for a possible merger.

Surprisingly, with a new round in the trade war now live and with the Fed set to hike rates in just a few days, the dollar initially pushed higher, but failed to sustain an early-London advance. Pound volatility was the highlight in options space for another day as Brexit headlines were in focus, while the euro advanced after stronger than expected German IFO data beat across the board, and ahead of a Mario Draghi speech Monday.

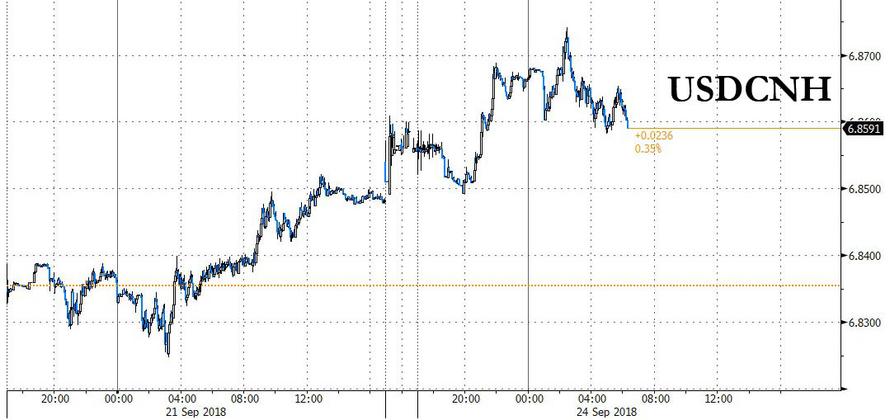

As the dollar declined, the Chinese yuan dipped, even more, weakening over 200 pips to as low as 6.87 as traders were unable to trade the Shanghai Composite which was closed on Monday.

Elsewhere in overnight FX trading, the euro reversing earlier losses to edge higher in early London session. The pound strengthened on increasing talk of a second U.K. referendum on the final Brexit deal, recovering above $1.31 as some traders took profit on short positions; as Bloomberg notes, the premium to protect against losses in the pound versus the dollar over the next three months has widened to the most since January 2017 after U.K. Prime Minister Theresa May said Friday that Brexit negotiations had reached an impasse. The Australian and New Zealand dollars declined, leading losses among the Group-of-10 peers, with the offshore yuan as China canceled trade talks with the U.S. and $200 billion of American tariffs on Chinese goods took effect after midnight Washington time.

As noted last night, JPMorgan said it was starting to factor into its strategy a growing potential for a “Phase III” of the tariff war next year affecting all Chinese imports, which would lead to weaker growth in the country and hit U.S. stocks. While the escalation in cross-Pacific trade tensions are proving a new test for global stocks which have posted two strong weeks of gains, today’s decline was virtually negligible in the context of the recent sharp move higher.

And with trade war progressing, attention now turns to the Fed’s policy meeting that will see rates increased for the third time this year, with markets pricing in another hike in December.

Elsewhere, market jitters continued in Indian shares where the rupee slid as cracks appeared in Asia’s best-performing stock market this year amid concerns about troubles in the shadow banking sector after IL&FS announced several defaults on Friday following by key management resignation.

Emerging-market shares and currencies initially weakened but have since recouped many of their losses as the dollar rally fizzled. The rupee and rupiah led a drop in Asian currencies; Hong Kong stocks fell the most in the region on a day when most North Asian markets were closed for holidays.

Treasuries declined with European sovereign bonds: the 10-year TSY yield gained 2 bps to 3.08%, hitting the highest in more than four months with its fifth straight advance. Germany’s 10-year yield increased two basis points to 0.48%.

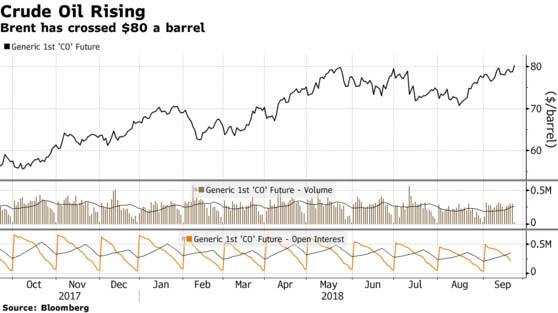

Crude oil hit a fresh cycle high, as Brent rose above $80/barrel, a 4 year high, after OPEC shunned U.S. President Donald Trump’s calls to increase supply. Looking at the oil rally, traders are looking increasingly convinced it has more juice, while the OPEC meeting on Sunday showed its members clearly have no urgency to boost their output.

Switching to gold, the bullion is still holding around its $1,200 level. Credit Suisse strategists have now abandoned their bearish view on the precious metal, while BofAML sees gold topping $1,300 on fiscal deficit. What’s in it for gold miners? Their valuation level is near an all-time low, the rand is weak and GEM stocks have underperformed their U.S. peers.

In the latest Brexit news, UK PM May’s aides have reportedly begun contingency planning for a snap election in November to save the Brexit talks and her job after EU leaders rebuffed the PM’s Chequers plan. Strategists have begun “war-gaming” an autumn vote to win public backing for a new plan, according to the Times. However, there were also reports UK Brexit Secretary Raab dismissed claims of a snap general election in Autumn, while playing down the chances of the government pivoting towards a Canada-style deal and EU officials are also thought to be working on a counter-proposal to Chequers, which is likely to appear in early October, the Guardian reported. Meanwhile, Telegraph said that a majority of the UK cabinet is now supporting moves towards a Canada-style Brexit deal. As such, May will now be asked to reassess her approach and opt for a free trade agreement that represents a ‘clean Brexit’. UK Cabinet Ministers will be required to grant limitless access to European Union migrants for more than two years after a “no-deal” Brexit, according to the Times. Such a move proposed by Home Secretary Javid will likely anger Brexiteers.

Leave A Comment