The safety bid this morning in bonds and bullion is very evident following the Turkish shooting down of a Russian fighter jet. The push higher began yesterday as the almost unprecedented downward spiral in precious metals hit what Goldman called “crucial levels,” and bounced.

As Goldman notes, in Gold, the critical level is 1,068-1,066. In Silver, support spans 13.98-13.83.

Gold Daily/Weekly – The level to watch in Gold is 1,068-1,066. This includes an ABC equality target off the January high and the trend across the lows since Dec. ’13.

The fact that oscillators are diverging positively suggests that price may be attempting to stabilize. Failure to break this support area confirms that the setup is still corrective; that a 5-wave sequence from ’11 highs ended in July. Alternatively, a break lower would warn that the market hasn’t yet completed its impulsive decline.

This would open potential to extend towards 966 (a 1.618 extension target from the January high).

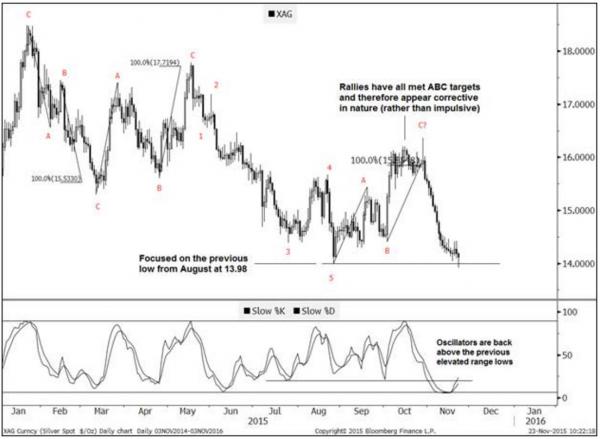

Silver Daily/Monthly – The level to watch here is 13.98-13.83. This includes the previous low from Aug. 26th and the trend across the lows since Jun. ’03.

Although the wave count on Silver is a lot less evident than the one for Gold, it is apparent that rallies have all met ABC targets insinuating that rallies lack impulse. On a more positive note, daily oscillators are crossing higher from the bottom of its range.

Put another way, the balance of signals seems mixed; 13.98-13.83 does however look significant.

Leave A Comment