Fundamental Forecast for Gold: Neutral

Gold prices were down this week with the precious metal off by 0.98% to trade at 1243 ahead of the New York close on Friday. The losses come alongside weakness in broader equity markets with all three major US indices flat / lower on the week. However, with concerns over a broader shift in the tone of global central bankers and growing doubts regarding the future of fiscal policy, gold is caught between a rock and hard place with the technical outlook also highlighting a near-term consolidation range.

Rhetoric from the FOMC, ECB, BoE & BOC continued to weigh bullion as concerns mounted that global central banks are becoming more inclined to scale back on their accommodative policy stance. The result has fueled a sell-off in bonds (rally in yields), putting pressure on non-yielding assets like gold.

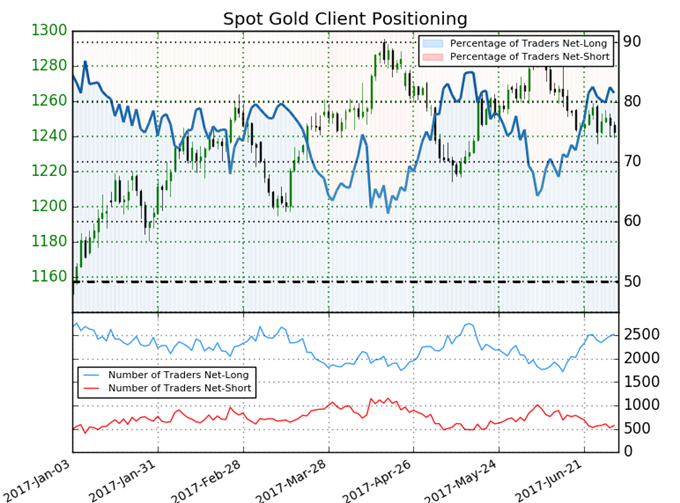

Highlighting the economic docket next week are the U.S. ISM figures, FOMC minutes and the June Non-Farm Payrolls report. With the Fed looking to begin offloading its massive $4.5 trillion balance sheet, U.S. data will need to continue to perform – as it stands markets are pricing just a 54% chance the central bank will hike in December. For gold, the outlook heading into the monthly open remains precarious with the decline now approaching broader up-trend support as sentiment begins to level off.

Leave A Comment