Stock markets in India are presently trading marginally higher. Sectoral indices are trading on a positive note with stocks in the realty sector and metal sector witnessing maximum buying interest.

The BSE Sensex is trading up 10 points (up 0.03%) and the NSE Nifty is trading up 8 points (up 0.1%). The BSE Mid Cap index is trading up by 0.1%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 64.17 to the US dollar.

In the news from the macroeconomic front, as per an article in the Economic Times, as per a finance ministry announcement, India will borrow an additional Rs 500 billion this fiscal year.

The above borrowing comes as a negative development as it could breach the fiscal deficit target for the first time in four years and also weigh on bond and equity markets in India.

This additional borrowing could raise the fiscal deficit to 3.5% of gross domestic product (GDP), higher than the stated target of 3.2%.

The government has budgeted spending of Rs 21.5 trillion in FY18. Of this, it had spent Rs 12.9 trillion by October with a fiscal deficit of Rs 5.25 trillion against a full-year fiscal deficit budget of Rs 5.47 trillion. And this has led to fiscal slippage concerns this year.

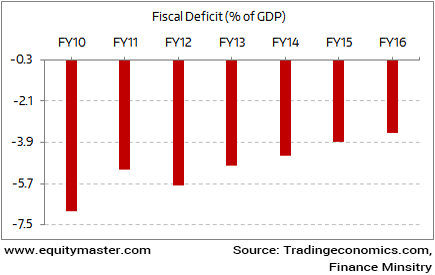

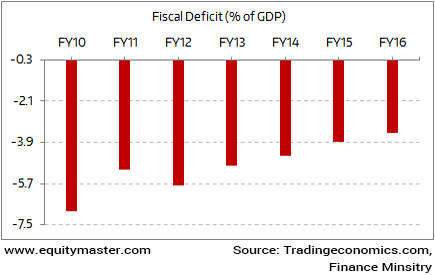

One must also note that in the last one decade, India is making serious efforts to reduce the fiscal deficit level. Ever since the new government came in it has been in favor of fiscal consolidation and meet the long-term fiscal deficit target of 3% by FY17-18. This will be the lowest target compared to the last couple of years, as can be seen from the chart below:

Fiscal Deficit target of 3% of GDP

That said, challenges remain in achieving the above-stated target. The notebandi exercise resulted in a slowdown. Further, the government announced a flurry of projects but the execution is still pending. This means the government needs to relax its spending to spurt the growth again.

Leave A Comment