On April 17, 2017 volatility expert Steven Sears wrote an article in Barron’s called “Profiting From the Stock Market’s Latest Fears.” In this piece, Sears recommends that long-term investors take advantage of rising market anxieties by selling put options. The most nervous investors can cope by “…stockpiling cash and buying some bullish call options to control equities they want to buy.” Sears acknowledges that timing is everything with these trades: he particularly advises put sellers to act when they think “fear is peaking.”

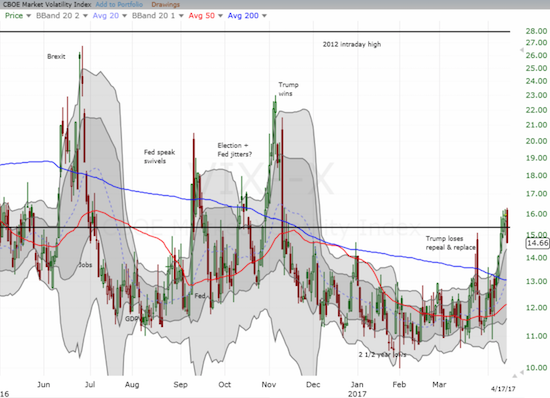

The period of extremely low volatility has indeed come to an end. When I wrote about the surprisingly benign implications of a period of extreme low volatility, I used twenty trading days as the duration over which the volatility index, the VIX, has to close above 11 to end a period of volatility extremes. The VIX last closed below 11 on March 3rd. The 20th trading day with the VIX closing above 11 occurred on March 31st. At that time, the VIX was in the early stages of its current run-up. Yet, fear in the form of volatility has not likely peaked. In the latest trading on April 17th, the VIX tumbled 8.2% to close below the all-important 15.35 pivot.

The volatility index, the VIX, may now establish a higher baseline pivoting its comfortzone around 15.35.

Source: FreeStockCharts.com

The ease by which the volatility index dropped below the 15.35 pivot suggests that the market is nowhere near a peak of fear. Yet, Sears characterizes this market as one full of fear based on search interest: “More people are Googling World War III than at any time since 2004.” The recent surge in searches on World War III are indeed remarkable. The interest in “World War III” as a topic is way off the charts! I include a comparison to “World War 3” as a search term (the topic is not available presumably because Google aggregated such topical searches into World War III).

Leave A Comment